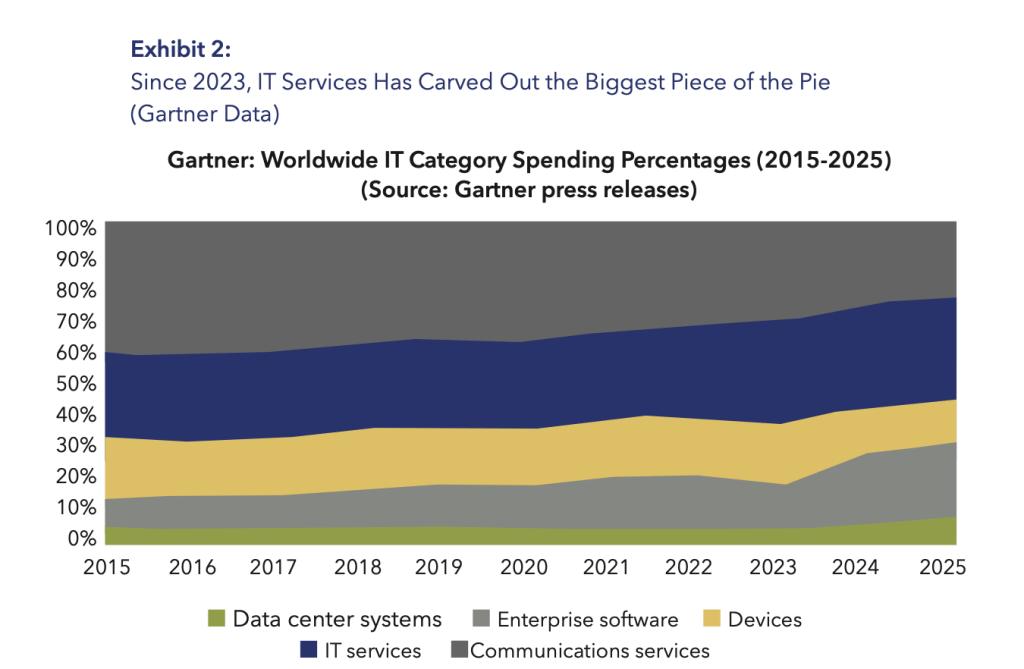

Longtime followers of the global information technology industry have known for years that the single-biggest segment is not software or computer hardware but rather telecommunication services. Perhaps that’s not surprising. Digital data

must travel instantaneously across offices, companies, and geographies to be useful, right? Indeed. In fact, in 2020 telcos accounted for 37% ($1.3 trillion) of the $3.6 trillion spent worldwide in total on IT, according to Gartner.[i] Telecom service revenue was more than twice that of the device makers and nearly three times that of software companies. The only sector close to telecom in 2020 was IT services ($992 billion).

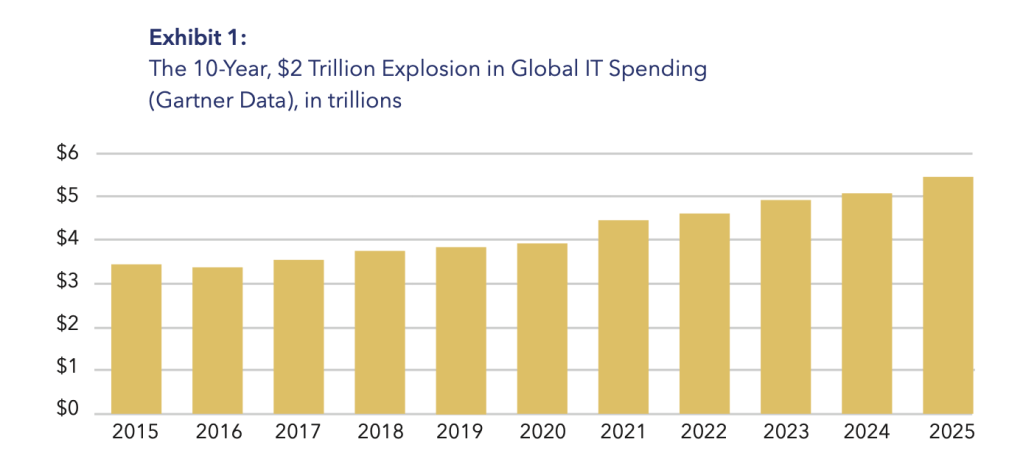

But who’s king in the IT industry has shifted this decade. For 2025, Gartner forecasts IT services will be in the lead, with 31% ($1.7 trillion) of a $5.4 trillion global IT spending pie. (To see how IT spending worldwide has increased since 2015, see Exhibit 1.)[ii] Communication services will be second (a 23.5% share) and software third (23%).[iii]

Why this epic shift in spending toward IT services? It’s their job to help companies deal with the huge complexities of AI and other digital technologies, and make unprecedented changes in how they operate. IT services firms are now the primary beneficiary of this need. (Exhibit 2.)

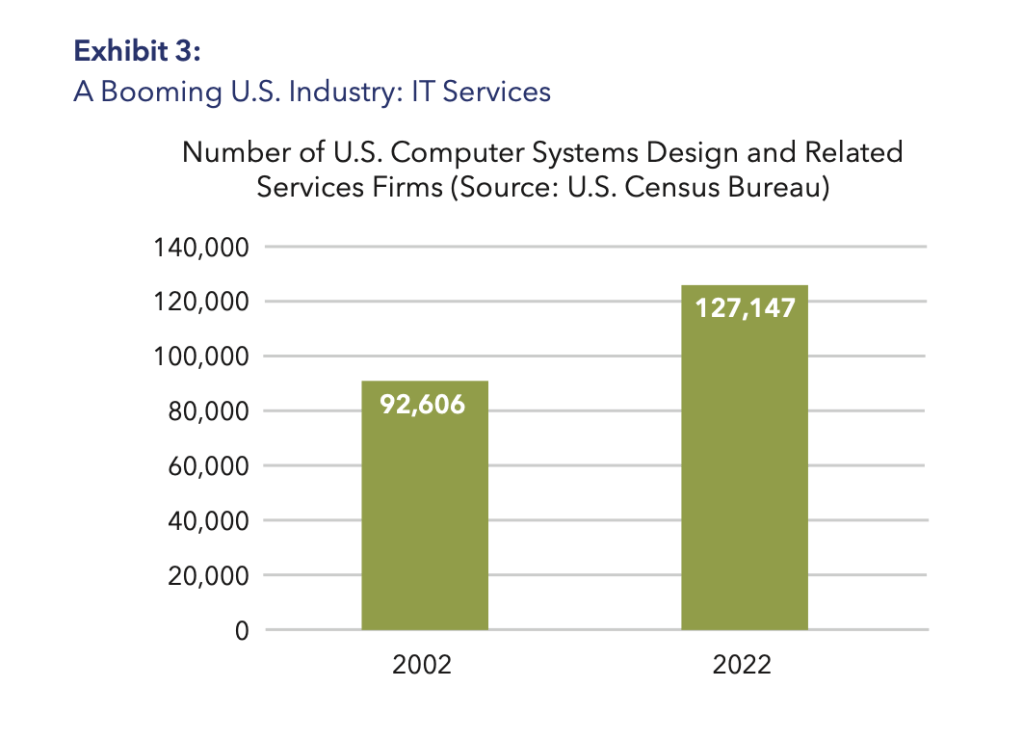

Yet IT services firms can’t get complacent. The reason is the insatiable demand for their services quite predictably has also been met with an increase in the number of those firms. According to U.S. Census Bureau data, the number of computer systems design and related firms in America grew 37% between 2002 and 2022, from 92,606 to 127,147.[iv] (See Exhibit 3.)

Exhibit 3: A Booming U.S. Industry: IT Services

Of course, the U.S. is not alone in launching new IT services firms. In India, whose IT services companies own 9% ($137 billion) of the global IT services industry,[v] startups appear to be proliferating. One gauge of that is membership to NASSCOM, the Indian trade association for IT services, technology and other digitally focused firms. A ChatGPT analysis of its membership estimates that another 200 or so Indian IT services firms joined between 2020 and 2025, bringing the total to about 2,100 of its more than 3,000 member firms.[vi]

The number of IT services firms around the world should continue to grow. The barriers to entry – always low – are even lower today. Employees can work from home; offices aren’t necessary. Just consider Dayton, Ohio-based Centric Consulting. The firm began with a remote workforce in 1999 and remains so to this day, with 1,300 employees.

Like those of the last 30 years, new IT services firms can tap talent from less-expensive regions of the world. Their people can learn online and earn a degree in software engineering without going to a college campus. What’s more, many tasks that used to require experts from multiple business and technology domains are now automated. AI looks like it’s poised to unleash a whole new set of IT services firms. Those with employees in talent-rich, lower-cost geographies and who can master generative AI stand to automate key aspects of software development.

That means clients of IT services firms have a burgeoning number of choices today that they didn’t five years, much less 10 years ago. That’s great for them — until the time comes to pick one for the job at hand.

As IT Services Firms Increasingly Sound Similar, Customers are Increasingly Confused

More competition in IT services means more customer confusion – especially with so many firms using variations of refrains that go something like “We help our clients use AI to engineer digital superiority.” Asked to digest such bland brand messages, companies that use IT services firms are having a harder time deciding which ones to put on their short lists. If your IT services firm isn’t recognized as having deep expertise in solving any of their problems, then clients will see you as having commodity services, if you’re seen at all.

That’s not attractive to clients. And it’s not attractive to the growing number of private equity firms that have been buying and selling IT services firms. “We never want to invest in a [tech services] company that’s basically doing commodity pricing,” Anup Hira, a partner at tech services-focused private equity firm Recognize, told us. “It’s a race to the bottom.”

Mounting customer confusion about which IT services firms to use is reflected in several recent studies of IT buyers. In a 2024 survey of 721 executives, 65% said IT purchasing decisions had grown in complexity, and that the average number of people involved in those decisions increased to 26, from 20 in 2022.[vii]

With all that in mind, we surveyed 200 executives this May about how they choose IT services firms. These executives spanned a range of functional areas: sales, marketing, service, finance, R&D, IT, procurement, supply chain, and others.

Nearly two thirds (64%) said they were the key decision-maker on the IT services purchase; 36% are part of the team that makes those decisions. Their companies’ average revenue was $11.7 billion, and 23% had more than $20 billion in revenue.

They were roughly evenly split among these sectors: banking, insurance, retail, media and entertainment, technology, consumer packaged goods, industrial manufacturing, transportation, travel and hospitality, telecom, and life sciences. Half work in North America, 30% in Europe and the UK, 16% in Asia-Pacific, and 5% in the Middle East.

We also surveyed IT services firms. We fielded an extensive survey (32 questions) of 300 people involved in thought leadership at these firms. We also interviewed more than a dozen producers and consumers of thought leadership, and IT services financiers and former strategy executives. From all this we gained a clear picture on the state of thought leadership in the tech services industry.

Let’s start with the customers of IT services firms. Our survey of executives who decide which IT services firms to use shows thought leadership is now a key factor in their buying decisions.

Customers Expect Thought Leadership from IT Services Firms

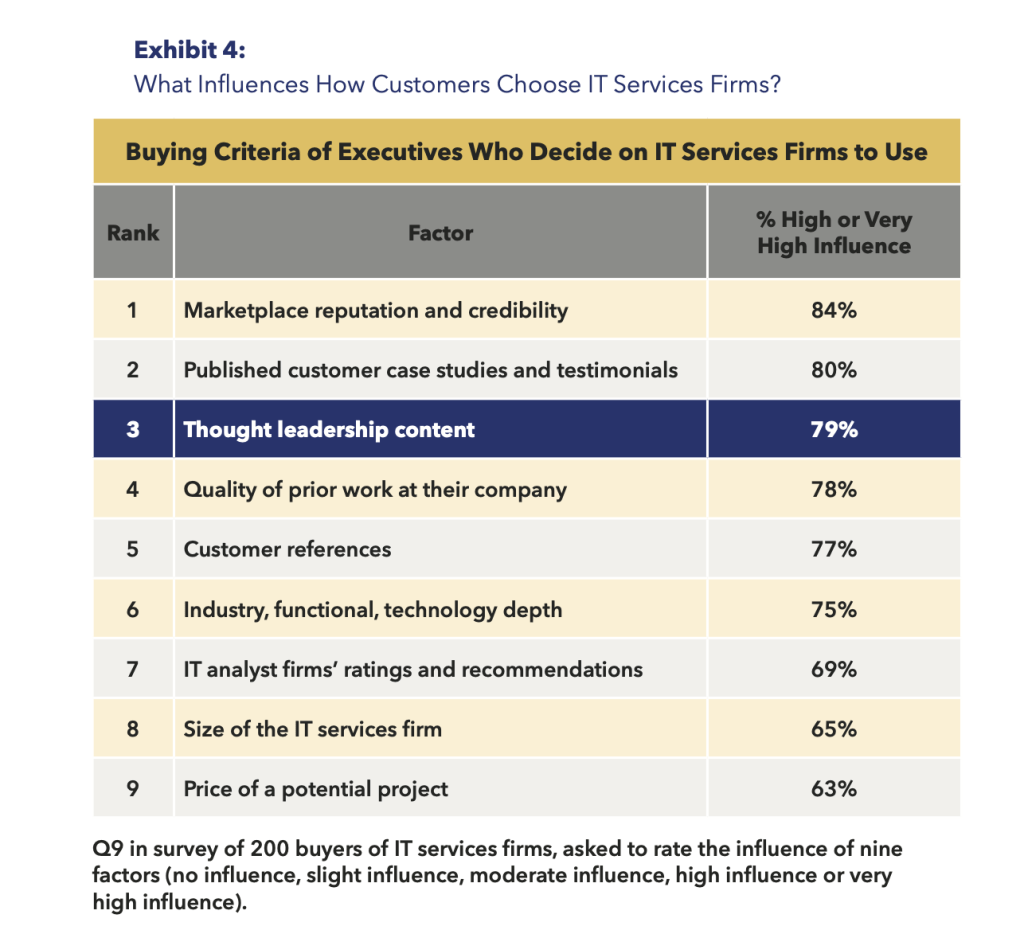

Our first major finding is that thought leadership content from IT services firms now greatly influences which firm their clients choose. We asked executives who play roles in deciding on which IT services firms to use to rate the importance of nine criteria to their purchase decisions. (We used a 5-point scale, from no influence to very high influence.)

At the top of the list is a tech services firm’s marketplace reputation and credibility. (See Exhibit 4.) We defined this as the recognition it has achieved through awards and other measures. What we found was that reputation tops all others. Some 84% of companies that use IT services firms said it highly or very highly influences their selection decision. This shows why brand marketing is crucial to the success of IT services firms. Without strong brand management, it’s hard to establish a strong reputation.

Ranking second was published customer case studies and testimonials, which 80% of the buy-side executives said is highly or very highly influential. Client case studies and testimonials are the proverbial proof in the pudding – the evidence that demonstrates a firm’s brand claims and quality of the advice it provides in its research reports, white papers, and conference presentations.

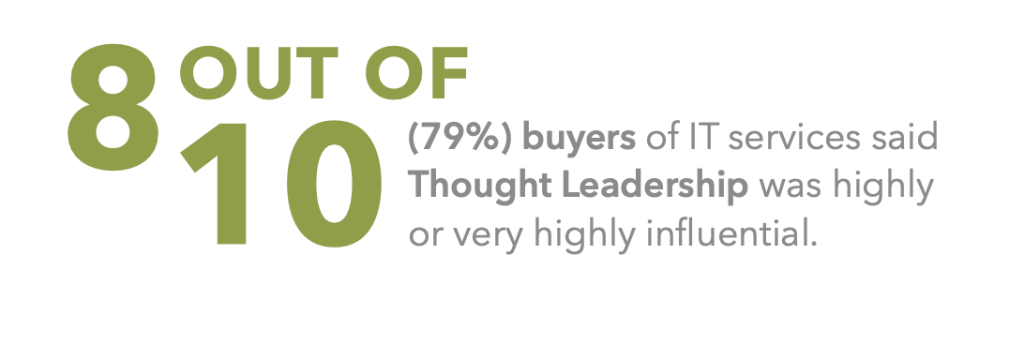

Those two factors didn’t surprise us as being at the top of the list. But what did surprise us was the third-ranking factor: thought leadership content. Nearly eight of 10 (79%) buyers of IT services said this was highly or very highly influential. We were surprised because it topped by a full 10 percentage points what they ranked seventh: IT analyst firms’ ratings and recommendations.

We’re not saying that IT analyst firms’ ratings are unimportant. In fact, 69% of buyers of IT services said they were highly or very highly influential on their choice of an IT services firm. How Gartner, Forrester, IDC, HFS, and others rate you still matters a lot. However, we know several IT services firms that spend much more time and money on trying to get the analyst firms in their camp than they do on thought leadership.

Thought leadership also tops, albeit slightly, other criteria that we expected to rank above it. One was quality of the work that those firms had done before at their companies (chosen by 78%), and customer references (77%). The quality of thought leadership content also topped:

- Showing industry, functional and/or technology depth (e.g., illustrated by the experience of the people listed in a project proposal)

- How big the tech services firm is, and

- Its fees/price for a project

The quality of an IT services firm’s thought leadership is a more important factor in clients’ purchasing decision than it was in 2020. About three quarters (76%) said reading thought leadership content from IT services firms is a more important influence than it was five years ago. Only 11% said it was less important.

Other surveys of executives who decide on which IT services to use have had similar findings. For example, a MomentumITSMA/Grist survey conducted in 2021 found thought leadership was critical to 50% of executives in evaluating potential advisors and solution providers. Quality content would make 78% think about working with such firms, and poor content would make 72% look at competitors.[viii]

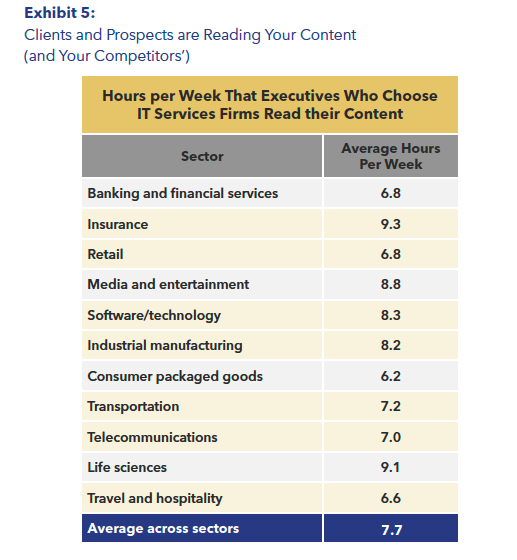

The importance of thought leadership to buyers of IT services shows up in the answers to another question in our survey. We asked these executives how much time they spend each week reading the thought leadership content from IT services firms. If you think less than an hour a week, you’d be far off. The average was 7.7 hours/week. That was about two hours more per week than what we found in 2022 in a similar survey.[ix] And more than one quarter (27%) of executives who select IT services firms spend more than 10 hours a week reading this content.

The most voracious readers of such content are executives in insurance (9.3 hours/week) and life sciences (9.1 hours/week). (See Exhibit 5.)

Clearly, thought leadership is important to buyers of IT services. But what about sellers? How much do they value the thought leadership content they bring to market? The answer was surprising.

[i] MomentumITSMA survey, “The Value of B2B Thought Leadership Survey 2023.” MomentumITSMA was purchased by Accenture in September 2025. https://itthoughtleadership.com/wp-content/uploads/2025/11/7c5fb-grist-valueofb2bthoughtleadership2023vm.pdf

[ii] Buday TLP, Phronesis Partners and Rattleback 2022 study “Rethinking Thought Leadership.” https://budaytlp.com/wp-content/uploads/2023/02/Buday-TLP-et-al-Thought-Leadership-Research-Report.pdf

[iii] Economic Times article, Feb. 24, 2025. It covered a 2025 Nasscom report that the Indian IT services sector had grown to $137 billion in revenue. https://economictimes.indiatimes.com/tech/information-tech/indias-it-industry-to-hit-300-billion-revenue-mark-in-fy26-nasscom-report/articleshow/118531334.cms?utm_source=chatgpt.com&from=mdr

[iv] The number of IT services members of NASSCOM were estimated by our inquiry in ChatGPT.

[v] Study by Foundry, a division of IDG. Press release of June 20, 2024. https://foundryco.com/news/2024-role-and-influence-study-finds-increasing-tech-purchase-complexity/

[vi] U.S. Census Bureau data from 2002 and 2022 (latest available). 2002 data: https://www.census.gov/data/tables/2002/econ/susb/2002-susb-annual.html 2022 data: https://www.census.gov/data/tables/2022/econ/susb/2022-susb-annual.html

[vii] Gartner press release, Oct.20, 2020. https://www.gartner.com/en/newsroom/press-releases/2020-10-20-gartner-says-worldwide-it-spending-to-grow-4-percent-in-2021

[viii] The data in Exhibits 1 and 2 came from gathering data Gartner has made publicly available in press releases since 2015 on its annual worldwide IT spending reports.

[ix] Gartner press release, July 15, 2025, disclosing its annual forecast of worldwide IT spending. https://www.gartner.com/en/newsroom/press-releases/2025-07-15-gartner-forecasts-worldwide-it-spending-to-grow-7-point-9-percent-in-2025