At IT services firms, we surveyed people involved in thought leadership. They work in a range of IT services firms, from very large ones (20% had revenue of more than $5 billion) to very small ones (5% had revenue of less than $100 million). Overall, the average revenue was

$2.6 billion; the median was $952 million.

Like their customers, did these IT services firms see thought leadership as instrumental to getting work? The answer is not to the same degree as their customers see it.

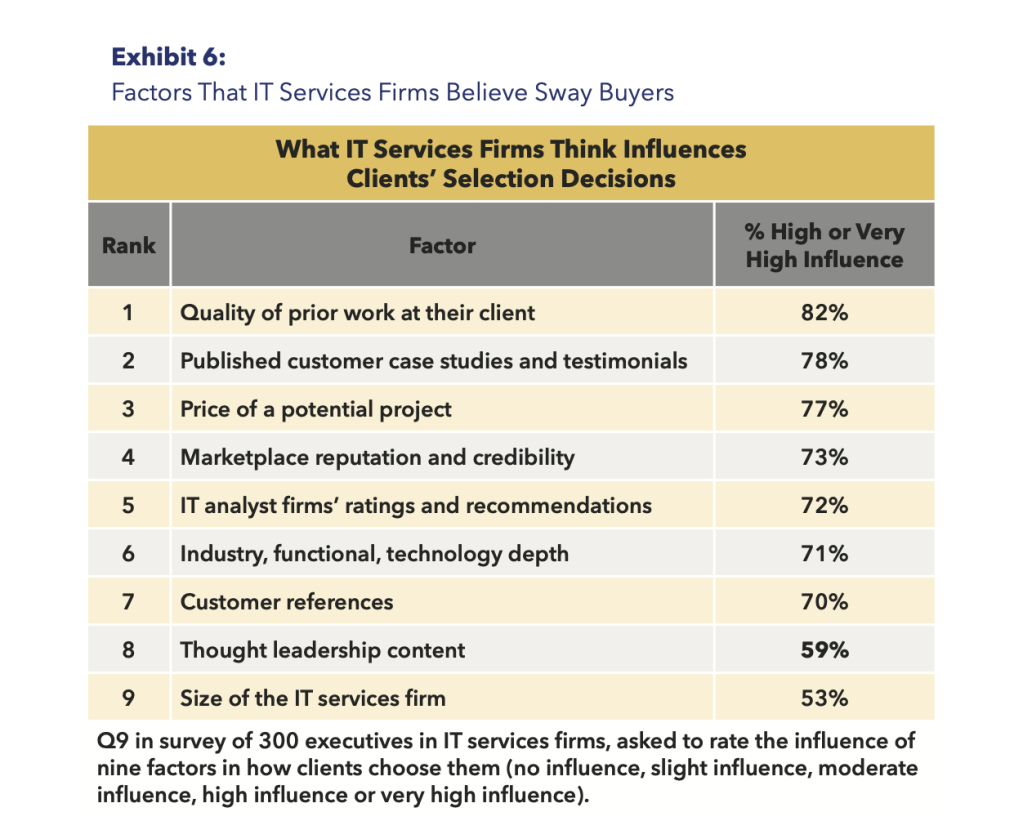

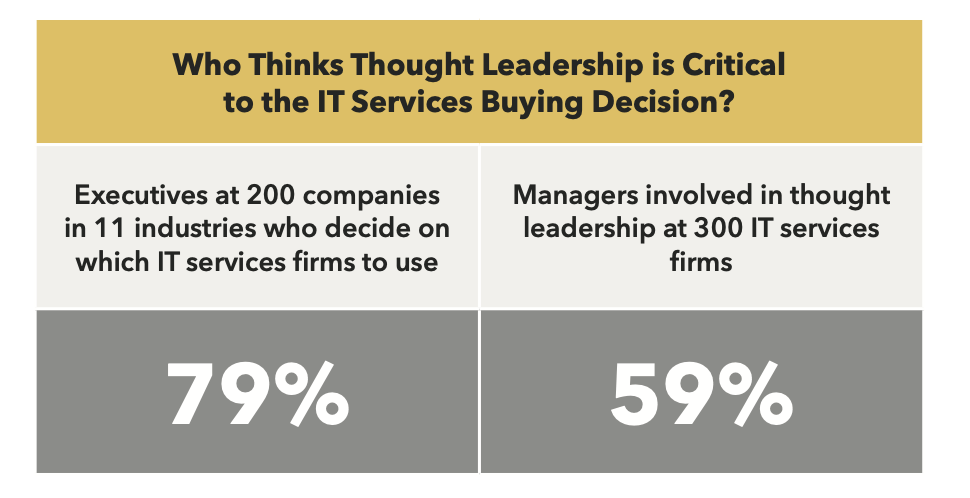

We asked thought leadership professionals at IT services firms to rate the importance of the very same buying criteria that we surveyed their clients on. (See Exhibit 6.) To our astonishment, IT services firms ranked thought leadership content eighth out of the nine criteria. Only 59% believe it is highly or very highly influential to their clients’ purchasing decision. That was a full 20 percentage points less than it was rated by executives who decide on which IT services firms to use. (See Exhibit 7.)

Instead, those on the sell side rated the quality of their prior work (82%), customer case studies and testimonials that they published (78%), and project price (77%) as the top three highly/very highly influential buying factors.

How can this be explained? Our view is that many IT services firms may underestimate the degree of client confusion about which firms to use. Not too long ago, competition was lighter and clients had fewer choices, and demand greatly outstripped supply. Your past work at a client was the best predictor of your future work, and being competitive on price was essential. That, in turn, meant tapping lower-cost regions of the world for IT talent.

Paltry Spending on Thought Leadership

With an outdated notion of the competitive landscape and customer needs for a deeper understanding of their capabilities, many IT services firms skimp on the people, research, and marketing investments required to be recognized as thought leaders in their domains.

Tech services firms spend 1.75% of revenue on thought leadership, for both content and marketing. In fact, 45% of the IT services firms surveyed spend less than 1% of revenue on thought leadership activities. Only 5% of them invest 6% or more of revenue on thought leadership.

Nonetheless, by 2027, the IT services firms that we surveyed expect to increase their thought leadership budgets an average 23.5%. Even so, that would mean the average IT services budget for thought leadership would rise from 1.75% of revenue this year to 2.16% in two years. Still, that’s less than half the 5.9% of revenue average across B2B sectors that we found in 2022.[i] And it’s a third of the 6.2% spent on marketing as a percentage of revenue in U.S. B2B services firms tracked in 2024 by Deloitte.[ii]

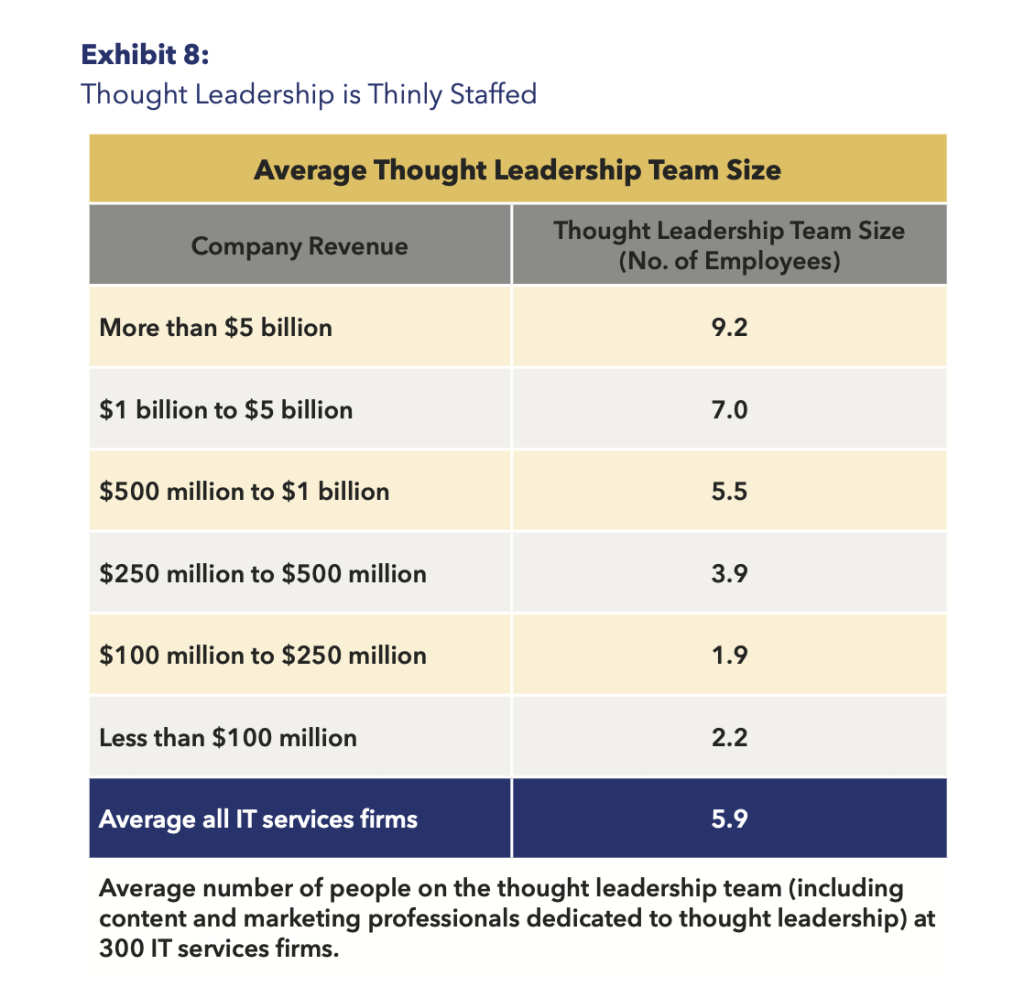

Another gauge of lack of investment is the number of people working full time on thought leadership. The average IT services firm surveyed has less than six (5.9 to be exact) people working full-time on thought leadership content and marketing of that content. And team size is directly related to revenue: The bigger the company, the larger the thought leadership team. (See Exhibit 8.)

Who Controls the Thought Leadership Budget?

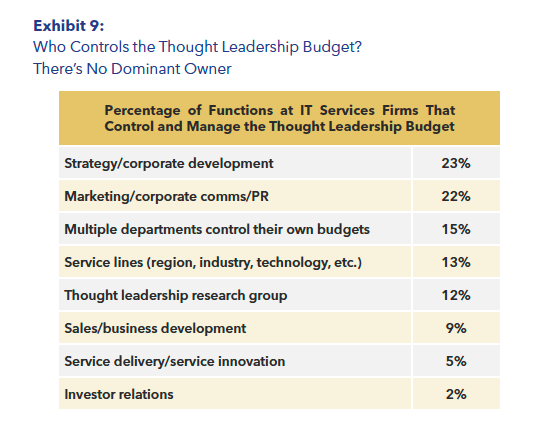

For the average IT services firm, the lack of attention to thought leadership can also be seen in who controls and manages its budget. In only about one in nine companies (12%) does a thought leadership research function control the budget. But our data shows that there’s no dominant manager of the thought leadership budget.

More commonly, the budget is managed by strategic planning/corporate development (in 23% of the firms), by marketing (22%), or by multiple functions (15%). Next come the service lines (by region, industry, technology, etc.), who managed the thought leadership budget in 13% of the IT services firms surveyed. A thought leadership research group finished ahead only of sales and service delivery. (See Exhibit 9.)

What does that say to us? It’s that thought leadership has barely evolved as a self-standing function in most IT services firms – self-standing in that it is given a budget and allowed to determine how to spend it.

Why Do They Invest in Thought Leadership and How Do They Measure the Impact?

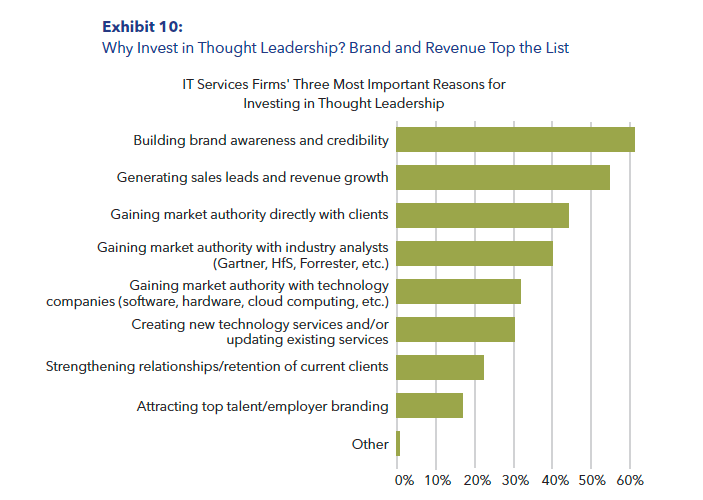

What are IT services firms hoping their thought leadership investments will achieve? We asked our survey participants to name the three most important reasons from a list of eight. (They could also choose “other,” although only two did.)

The most frequent reason is building brand awareness and credibility. It was cited by 61% as a top three factor. (See Exhibit 10.) Following that was generating sales leads (54% picked that). And 44% chose gaining market authority – i.e., having clients see them as an expert in some area (vs. having a third-party confer that authority).

Close behind (chosen by 40%) was influencing IT analyst firms so that they’d recognize their IT services firm as an authority. That was cited more often than was gaining market authority with software, hardware, cloud computing, and other technology companies.

Only 30% of IT services firms said using thought leadership to create new services or update existing services was a top three reason for investing. And even fewer (22%) said customer retention was one of their three most important goals for thought leadership.

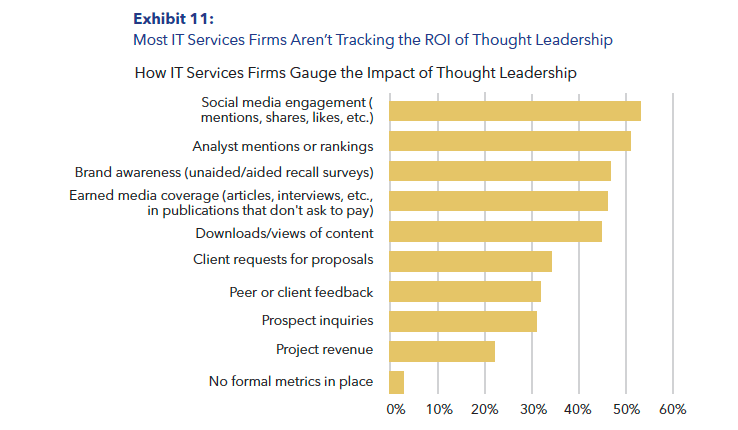

We then asked how they measure the impact of thought leadership. We provided 10 metrics and asked which ones they use.

First, the good news: Only 3% had no formal metrics for gauging the impact of their thought leadership activities. Now the bad news: For the 97% who have metrics, the most frequently used were not revenue, leads, and proposals — as we would hope, given that we believe thought leadership should help drive market share leadership.

Instead, they more often cited other metrics that can’t be turned into dollars and cents. The most common (cited by 53%) was social media engagement (likes, shares, mentions). (See Exhibit 11.) Slightly behind (at 51%) were mentions or rankings by the IT analyst firms. Following that were brand awareness (47%), earned media coverage (46%), and downloads or views of thought leadership content (45%).

Far less frequently cited metrics were revenue-related:

- Requests for proposals (34%)

- Inquiries from potential clients (31%)

- Revenue (22%)

That tells us this: Most IT services firms depend on non-financial metrics because they can’t directly connect thought leadership to client purchasing decisions. Many of these people, since they can’t prove that thought leadership impacts the top line, aren’t willing to argue that it does, even if they have anecdotal evidence.

Over the years, we’ve heard some get into a defensive crouch, telling executives not to expect thought leadership to drive revenue, only “brand enhancement.” But this becomes a problem during downturns when corporate functions must justify their budgets. With no proof it moves the revenue needle, thought leadership budgets often get squeezed.

Does Thought Leadership Drive Revenue? Most Say “If at All, Not Much”

We then asked our IT services participants what impact, if any, their thought leadership programs have on revenue growth. Nearly two-thirds (64%) said “none,” “slight,” or “moderate” impact. In contrast, far fewer — 36% — said “high” or “very high” impact. But of those, only 12% said “very high.”

That makes our findings on how they measure thought leadership more understandable. Most IT services firms don’t measure the revenue impact it because they don’t think has much, if any, revenue impact.

Biggest Barriers to Improving the ROI on Thought Leadership

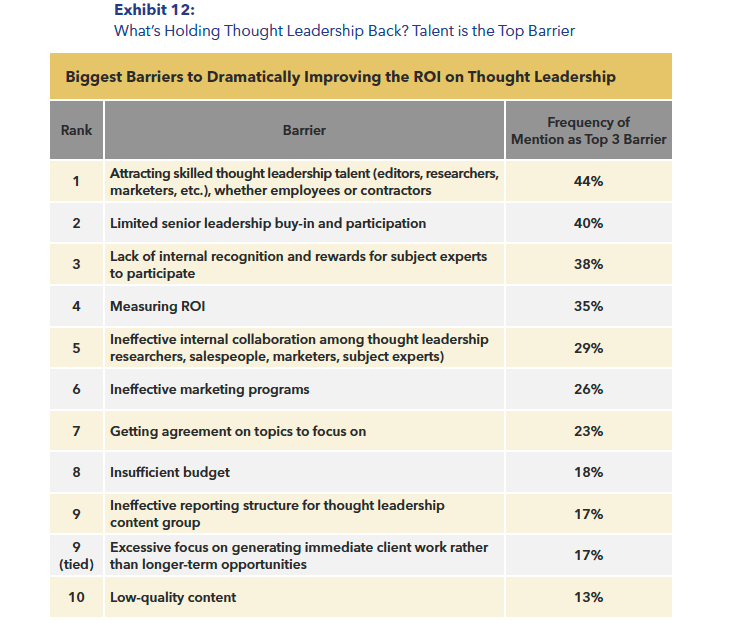

Whether or not IT services firms rigorously measure the revenue impact of thought leadership, we wanted to know what holds them back from getting higher financial returns. We asked them to choose the three biggest barriers to improving their returns from a list of 11.

None of the barriers stood head and shoulders above the others. The four most often chosen barriers were: lack of thought leadership talent; limited buy-in and participation by senior managers; lack of internal recognition and rewards for internal experts to participate in thought leadership programs; and difficultly measuring the ROI. (See Exhibit 12.)

Low-quality content rarely was a top three barrier (chosen by only 13% of the respondents). Twice as many said ineffective marketers were a top three barrier.

[i] “Rethinking Thought Leadership” study. We surveyed 10 sectors, including IT services, management consulting, software, technology hardware, accounting, and legal services.

[ii] The CMO Survey report in 2024, sponsored by Deloitte, Duke University’s Fuqua School of Business, and the American Marketing Association. https://cmosurvey.org/wp-content/uploads/2024/11/The_CMO_Survey-Highlights_and_Insights_Report-Fall_2024.pdf