If some IT services firms are generating very high revenue impact from thought leadership and others are generating none, this begs the question: What are the former doing that the latter aren’t doing? This is the most important issue that we explored.

The answers from the survey respondents who said “no” impact or “very high impact” were the ones we felt were most critical to compare. That is where the biggest insights come from for any thought leadership research – including studies on the practice of thought leadership itself, which is what this one is about.

With that in mind, we wanted to know whether the IT services firms that answered “very high impact” or “no impact” differed significantly on how they answered our other survey questions. If there were stark differences – in how much they spend, where thought leadership reports, how they produce and market content, and other areas – it would shed light on what all IT services firms need to do to turn their thought leadership activities into revenue generators.

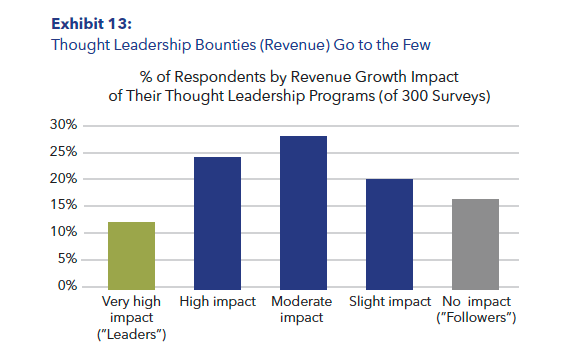

To quickly identify these two subsets of our survey participants, we’ll refer to those that said thought leadership had very high impact (36 surveys, or 12% of the 300-participant survey base) as “Leaders.” And we’ll call those who said no impact (47 respondents, or 16% of the base) as “Followers.” (See Exhibit 13.)

But first, one factor that doesn’t show a big difference is the size of companies that we term “Leaders” and “Followers.” We point this out because you may think that generating revenue from thought leadership requires a huge budget – an immense investment that only the largest IT services firms could fund (e.g., Accenture, IBM, Capgemini, etc.). But the average size of the “Leaders” vs. the “Followers” in our survey doesn’t indicate that. The average revenue of “Leaders” is larger than that of “Followers,” but only by 24%: $3.1 billion vs. $2.5 billion.

So thought leadership doesn’t necessarily favor those with the deepest pockets.

Now let’s deeply explore what IT services “Leaders” and “Followers” at thought leadership do differently. We’ll also present how they compare to the average for all 300 IT services firms surveyed.

We’ll compare Leaders and Followers in seven areas:

- Investments: Spending more overall, and more on research.

- Measures: Monitoring content quality (more than quantity) and its top-line impact.

- Processes: Developing rigorous methods for creating content (both research- and non-research-based), and for creating client demand for the related services (i.e., determining the optimal marketing mix, and equipping salespeople to sell as thought leaders).

- Advocates: Creating the right types (internal leaders who view thought leadership as a competitive advantage in demand creation and service innovation) and in the right places (leaders who can put those beliefs into action).

- Connections: Explicitly tying thought leadership research to both demand generation activities (marketing and sales) and to service innovation (methodology development and training & development) so the firm can meet rapidly increasing demand for its services with high-quality supply.

- Talent: Attracting and developing people to gain the rare skills of conducting exceptional best-practice research, luring buyers with that content (writing articles, visualizing data insights, running seminars, etc.), teaching salespeople how to sell with it, and helping service delivery managers ramp up supply.

- Structure: On the organizational chart, making sure the thought leadership content group does not report to marketing, sales or service delivery, but rather to strategy, corporate development, or another high-ranking officer so that thought leadership can fuel demand- and supply-creation without becoming captive to either.

The first letters of those seven areas purposely turn into the acronym “IMPACTS.” (That should make them easier to remember!) More importantly, we use this acronym because our research and collective decades of experience in thought leadership at IT services firms demonstrate that if you excel in these seven areas, your thought leadership investments should shift from being a cost center to a revenue producer.

Let’s explore each factor, and how Leaders, Followers, and the average IT services firm fared on them. On each front, we then explain what to learn from the Leaders on how to turn thought leadership into a competitive advantage.

Investments: Spending More Overall, and On Research

The issues of how much to invest, and on what, clearly separate the best IT services firms at thought leadership from the worst (Exhibit 14):

- Leaders spend six times what the Followers spend: 3.2% vs. 0.5% of revenue.

- Followers invest 71% less on thought leadership content development and marketing than the average IT services firm: (0.5% vs. 1.75% of revenue).

- When asked about the size of their thought leadership budget in 2027, Leaders predict a 25% increase on average from their 2025 budget; Followers expect only a 6% boost.

Large spending differences between Leaders and Followers also show up in what they spend their budgets on. We asked survey participants to estimate how much of their content investments went to research studies (surveys, best-practice case study research, etc.) and non-research content. By non-research content, we mean such things as interviewing the firm’s consultants and other experts to produce white papers, blogs and other articles, or having them write those articles themselves. Increasingly, IT services firms are turning to generative AI to crank out such content, as you’ll see later in the report.

The Leaders spend the majority of their content budgets (57%) on research-based content. That is more than twice the percentage of the Followers, which spend 28% of their content budget on research. The average across all IT services firms was 42% on research. (See Exhibit 14.)

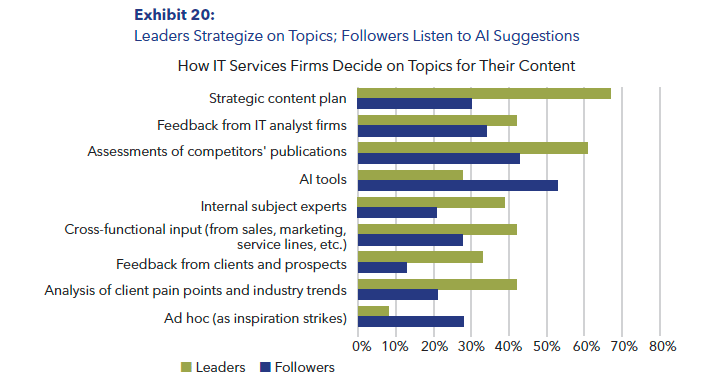

What’s more, Leaders appear to focus their investments on fewer topics than do Followers. We make this observation on a question we asked about how their companies choose topics. The highest percentage of Leaders (67%) said they devise a content strategy plan, which then determines what topics they’ll create content on. That was more than twice the percentage (30%) of Followers; they are more likely to take a tactical approach to topic choosing. For example, 53% of Followers turn to AI for topic suggestions, making it their most frequently used approach.

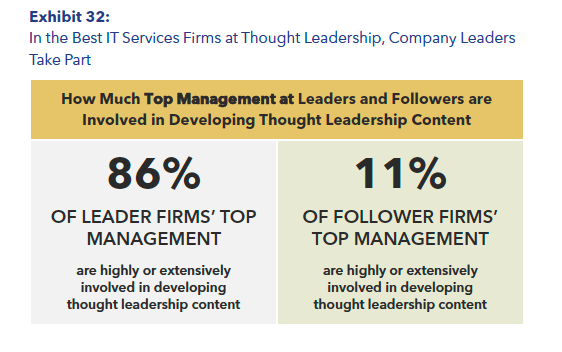

Answers to another survey question further suggest that Leaders are more intentional about how they allocate their investments. When asked about their leadership team’s involvement in content development, 86% of Leaders characterized it as “highly” involved or playing a “critical role” (meaning, they drive topic strategy and other aspects of thought leadership). In contrast, only 11% of Followers said the same thing; 60% of these IT services firms said their leadership team was not involved at all or had only limited involvement.

For its thought leadership programs, India-based Tata Consultancy Services (revenue of $30 billion) has invested heavily in primary research since 2011, when it conducted a study on cloud computing, surveying more than 600 companies. Every year since then, it has conducted surveys of large global companies worldwide on a range of digital business topics including social media, AI, Internet of Things, and cybersecurity. “There is no way that thought leadership can make an impact and give us a differentiated voice without research,” says Serge Perignon, global head of TCS’ Thought Leadership Institute and services marketing. “It’s very hard to break through all the noise without very specific data points. We need our own data, our own voice, our own points of view. Research-based thought leadership is a paramount ingredient to impactful marketing.”

From our experience, the 72% of the content budget that Followers spend on non-research content typically captures internal subject experts’ knowledge gained from their client work. While this is important, SME views often reflect insights they’ve gained from a few dozen (at most) client projects. That is far fewer than those that are gained when best-practice research explores the experiences of multiple dozens or hundreds of companies.

All to say, thought leadership research based on anecdotal or even deep experiences with just a few clients won’t deliver the rare insights that must be gained today to produce groundbreaking solutions to complex issues.

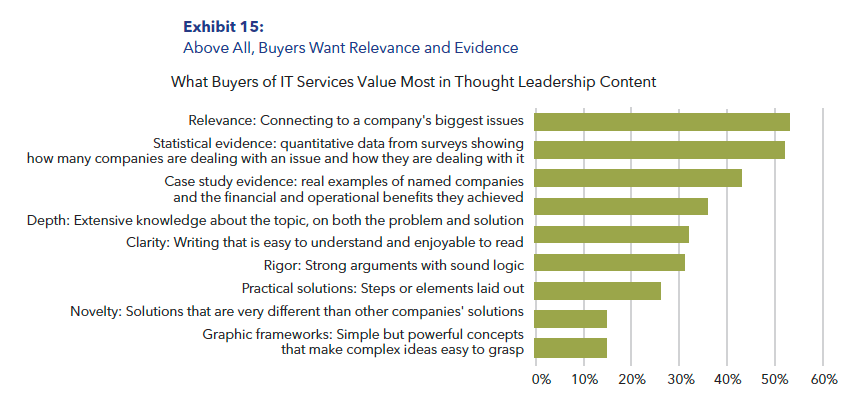

From two questions that we asked, the 200 executives in 11 industries that choose IT services firms indicate a strong preference for extensive best-practice research. One question was about the qualities of thought leadership content they valued. We gave them a list of nine and asked them to list the three they valued most. (See Exhibit 15.) The three most frequently mentioned were:

- Relevance: That the content addressed a big issue at their company (chosen by 53%).

- Statistical evidence from quantitative surveys showing how many companies were dealing with an issue of relevance. 52% chose this.

- Case study evidence of real companies (identified by name) that shows how they are dealing with the issue. 43% chose this.

In our conversations with such executives, they spoke about the value of primary research, especially real case studies. Says Micah Friedman, chief transformation officer at UK-based company Edyn Limited, a $100 million revenue hospitality services firm[i]: “The experience of solving problems – done in case examples – is where you can see qualitatively how the problem was solved and the outcome.”

Eric Singleton, a former CIO at consumer goods, technology companies and government agencies, and co-founder of Strax Networks (an augmented reality marketing services firm), agrees. “I’ve always felt that case studies carry a different aura for me. If it’s a good one … that aligns with what you’re doing, then we follow up [with them]. They’re in sort of a class of their own.”

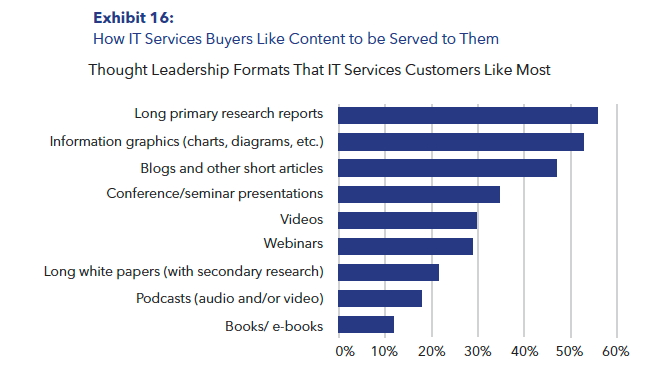

The other question asked was about which formats of thought leadership they find most valuable. By “formats,” we mean research reports, white papers based on secondary research and authors’ experiences, blogs and other short articles, videos, webinar or conference presentations, books, and more. Here again, we asked them to pick three out of nine formats that we listed. The most frequently valued format was long primary research reports. (See Exhibit 16.)

While we didn’t ask our IT services respondents this, we know from our own client experience and interactions with thought leadership professionals that the thought leadership research budget usually pales in comparison to the thought leadership marketing budget. And when compared to the total marketing budget, spending on thought leadership research typically is a fraction of that.

Our conclusion on thought leadership investments: IT services firms that want to differentiate their services and get market attention must invest in rigorous primary research that unearths best practices in the marketplace – including their clients and other companies — on issues relevant to their clients.

And, of course, that research needs to be in synch with their firm’s service strategy. Why research a fascinating issue that the firm has no intention of building a service around? (You might laugh, but we’ve seen this several times. It often happens when a practice leader or other individual plans to leave an IT services firm with a new area of expertise that captures their fancy.)

If funding for deep best-practice research somehow can’t be justified, the discussion should be about where to reallocate some budget. A marketing budget with sizable investments in brand-building events (e.g., sports sponsorships), IT analyst road shows (remember: a higher percentage of clients see thought leadership as more influential in their IT service purchasing decisions than IT analyst recommendations), and other activities might be a good place to look.

A last note about thought leadership research: The IT analyst firms have long promoted their services in conducting co-branded thought leadership research for their clients, which of course include IT services firms. But with co-branding comes an intellectual capital issue. Are the insights truly from your company? Or are they from the analyst firm that conducted the study with or for you? We believe your audience will figure it’s the analyst firm, particularly because their business is conducting research.

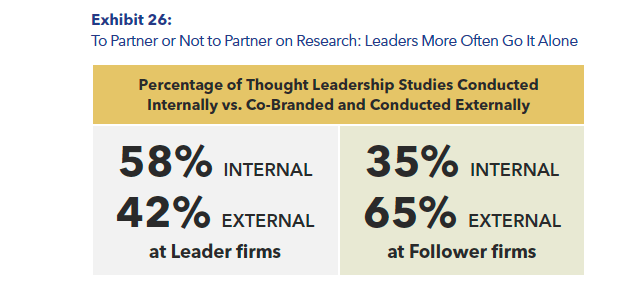

This is another issue on which the best IT services firms at thought leadership differ significantly from the worst. On average, the Leaders brand 58% of their research studies as solely their own; they co-brand 42% of their studies with IT analyst firms, publishers, and others). In contrast, the Followers co-brand 65% of their research studies, and brand 35% of their studies as their own.

Largely speaking, we think the disadvantages of co-branding a study with another organization – unless they are a business partner that you bring onto your projects (or vice versa) – outweigh the advantages. Not everyone agrees with us. Ben Pring, a former vice president and analyst at Gartner and the co-founder and leader of the Cognizant Center for the Future of Work, told us: “If you’re a no-name [IT services] brand and you’re trying to get established, there’s no obvious solution to it. You can do it yourselves and control it and could be really high quality. But if nobody knows your name, you can’t get any visibility for this in the marketplace. It’s just a tree falling in the forest. But if you go with a brand that you’re trying to leverage, then perhaps it gets watered down. It becomes a bit ‘me too.’ You can’t control it as much. That tension is always there.”

Tackling the “Quality is in the Eye of the Beholder” Problem (Sidebar)

Measuring: It Boils Down to Gauging Content Impact and Quality

In 2023, IBM’s thought leadership research group, the IBM Institute for Business Value, unveiled the results of groundbreaking survey of more than 4,000 top executives around the world (average size company was $14 billion in revenue). The study asked them whether reading thought leadership content from consulting, tech services, and other firms directly influenced their decisions on which ones to use. The answer in many cases was a definitive yes. The IBM researchers calculated that thought leadership influenced $265 billion in such purchases annually, including $99 billion in technology purchases alone.[i]

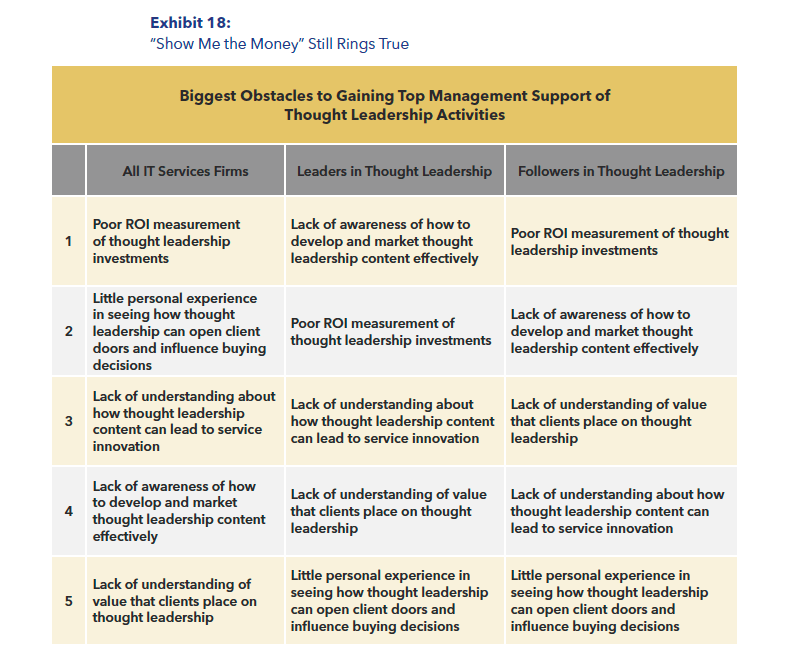

Yet despite growing statistical and anecdotal evidence that high-quality thought leadership content and effective marketing produces revenue, many thought leadership professionals still must prove the ROI. We saw this in the answers to a survey question that asked them about the biggest obstacle to getting top management support for thought leadership. (We provided five obstacles, along with the ability to indicate that there were none in their firm – i.e., that they already have top management support for thought leadership.)

Across all 300 IT services firms, the most frequently mentioned barrier was poor ROI measures. Not surprisingly, it was the biggest obstacle in the Followers, but not in the leaders. (See Exhibit 18.)

What’s more, you could compile strong leading indicators of the future performance of your thought leadership campaigns. But why measure that, you might be asking?

Here’s our logic: Ultimately, the payoff from thought leadership comes when clients read a research report, white paper, conference presentation, and/or other content from an IT services firm and decide, “They have the expertise we need.” Yes, there must be a chemistry fit between the client and the IT services firm’s client officer, the person(s) who sells the work, and the project team. However, it’s the expertise revealed in the thought leadership content that gets the client to think “They’re better.”

If you agree with that logic, then it behooves the thought leadership group– most of all – to produce outstanding content consistently. The nine criteria we mentioned earlier – novel solution, relevant problem, case study evidence that the solution is effective, and the others — can all be measured. At the very least, you can make what appear to be subjective evaluations far less subjective, and perhaps objective but based on arbitrary indicators. (Example: You could say that every article you publish needs at least three real examples of named companies whose improvements were quantified in financial terms.)

If you produced and measured every piece of content with that criteria in mind, you’ll have a scorecard of the quality of your content. If you’ve done what’s necessary to make every or most pieces of content strong, you could have a good leading indicator of how many leads that content will produce.

Does that sound far-fetched? We don’t think so, looking at other industries that have measured the quality of their products to try to predict future demand. Back in the 1980s, the late Harvard Business School professor David Garvin found that Japanese car companies’ higher-quality automobiles helped them increase their share of the U.S. market.[ii] Bain & Company, the consulting firm, has claimed for years that in most industries its Net Promoter Score of a company’s products or services can predict 20% to 60% variations in organic revenue growth among competitors. “In other words,” says the company’s NPS website, “a company’s NPS is a good indicator of its future growth.”[iii]

We think the same quality principles that have been used for decades in other industries should apply to thought leadership content.

Processes: Using Rigorous Methods for Content Development and Marketing

In our survey, we wanted to assess the techniques IT services firms use to develop and market content that they hope their audience will view as “thought leadership.” We begin here with our findings on their content development processes. We then follow that with our findings on marketing.

Quality software is the result of highly skilled people following rigorous methods for determining requirements, designing an “architecture” that enables the resulting system to be updated quickly rather than having to be torn apart, and writing code. All that is important, whether the engineers use agile or waterfall approaches.

Like quality software, creating consistently high-quality thought leadership content requires rigorous methods and talented people in each stage of the content development process. And without consistently high-quality content, IT services firms will waste a lot of marketing and sales investments in trying to peddle me-too, superficial ideas.

That’s our experience. It’s also what can be concluded from the data we collected from four survey questions:

- How IT services firms come up with the topics that they write about and present in speeches, webinars, and what not.

- What processes (including content quality standards) – if any – they use to create non-research-based content on the topics they choose (e.g., white papers based on internal subject experts’ client work, secondary research, etc.).

- What guidance they give content developers on thought leadership studies they conduct.

- Whether they are using generative AI to accomplish the three prior points: determine topics, create content, and produce research reports.

Our overriding conclusion is that thought leadership content development at most IT services firms (and perhaps most B2B firms, period) is an idiosyncratic endeavor. If you looked at most of these firms, you’d find their researchers, writers, editors, and consultants (writing their own content) using their own methods.

That’s a recipe for considerable inconsistency: great content followed by poor content followed by average content followed by poor content, and so on.

We’ll look at what the average IT services firm does in content development, and what the Leaders and Followers do differently (if they are different).

Most IT Services Firms Don’t Have Solid Methodologies for Content Development

A rigorous process for thought leadership content development begins with determining what topics a firm should invest in developing content for, within a given timeframe. Should the number of topics align with its service lines – e.g., five out of 10 topics devoted to a service line generating 50% of the firm’s revenue this calendar year? Should one topic be on a future service line? Should more than one – for example, to test the waters of a new service line that hasn’t been launched?

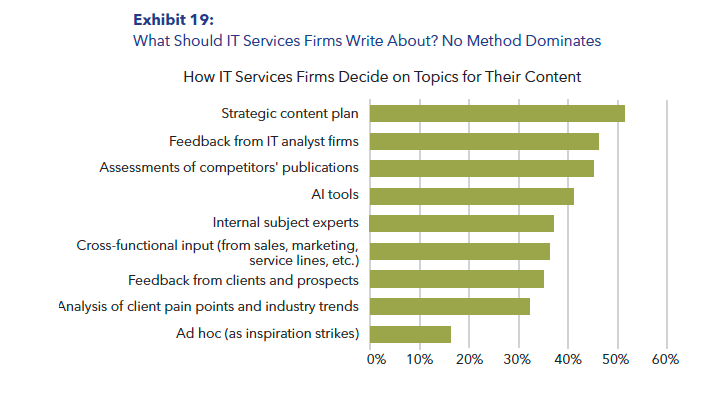

With this in mind, we first asked our 300 survey participants to explain how they chose topics. (See Exhibit 19.) We had them check off one or more of nine common ways to choose topics. Most frequently (by 51%), they determine their choices from a strategic content plan. That’s good, but of course that means nearly half don’t do that. Almost as many (46%) let IT analyst firms tell them what to write about, and nearly the same number (45%) look at what competitors publish. Many (41%) ask AI for topic suggestions. Less than 40% use internal and customer input to determine topics.

How do the best IT services firms at thought leadership – our “Leaders” – decide what topics are in or out? Most frequently, they create a content strategy that determines topics. Two-thirds (67%) do that, nearly twice the percentage of the Followers (30%). Leaders’ second most frequently used tactic is competitor assessment, used by 61% vs. 43% of Followers. (See Exhibit 20.)

Surprisingly, Followers most frequently use AI to decide what to write about. More than half of them do this (53%). We must note, as you’ll read in the sidebar (“Generative AI in Thought Leadership”), more Followers than Leaders use AI in the different aspects of the content development process that we asked them about.

We then asked IT services firms to give us an overall idea of how they create thought leadership content – whether research-based or not – after the topics are selected. We offered four choices, from least rigorous to most (Exhibit 21):

- No formal process was in place. About one in five said this (22%).

- A process that leaves great room for interpretation and execution (e.g., a barebones, one-page outline, or vague quality criteria). Some 37% chose this.

- A process that prescribes the stages of content development, the structure of content, the writing style and tone, etc. Only 21% chose this.

- A process that explicitly states the qualities of compelling ideas; a narrative structure for explaining the ideas; how to convey them; and how to display them (use of graphs, charts, frameworks, photos, videos, audio, and other non-text elements). The fewest number of IT services firms chose this — 20%.

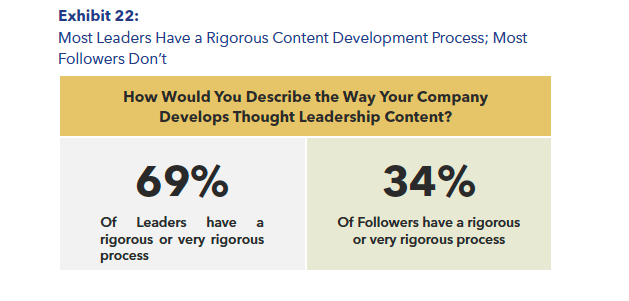

From this data, we argue that a strong majority of IT services firms – 80% — do not have a rigorous process for content development. Only one in five does.

This is a major difference between the best IT services firms at thought leadership (the Leaders) and the rest. Nearly 70% of Leaders had a rigorous or very rigorous process. That was more than twice the number of Followers (34%). (See Exhibit 22.)

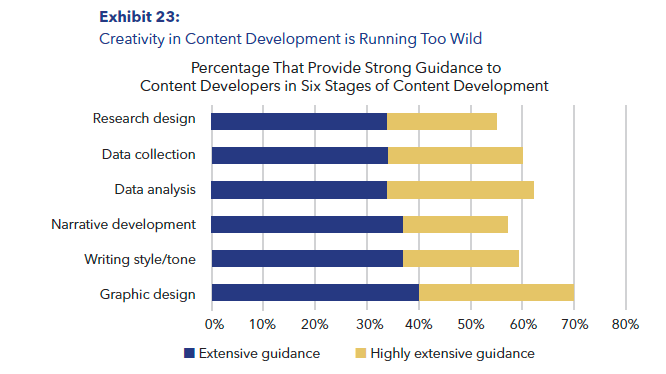

But weren’t satisfied with leaving our benchmarking of content development rigor at that high a level. Toward that end, we asked IT services firms how much guidance they give their content developers (whether employees or outside agencies, including survey houses) in six fundamental stages of the thought leadership content development process. They answered each question on a five-point scale, from “no guidance” to “highly extensive” guidance.

In each of those six stages, on average only a minority (30% or fewer) of IT services firms give content developers highly extensive guidance. (See Exhibit 23.) But the picture looks better when you combine survey respondents who said “extensive” guidance with those who said “highly extensive” guidance.

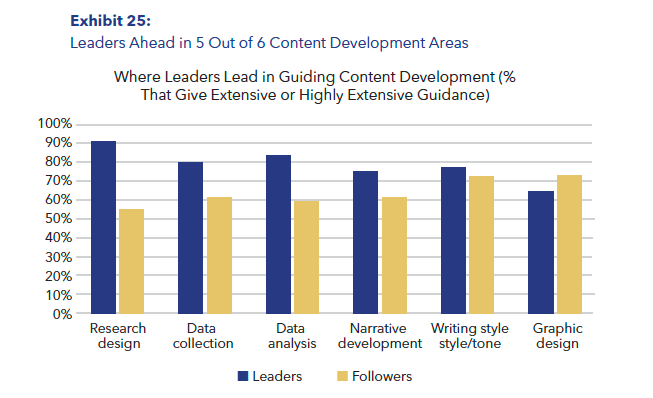

How do the Leaders and Followers compare on this front? Combining their “extensive” and “highly extensive” guidance scores, Leaders provide more guidance in five of six content development areas. The only arena in which the Followers provide more guidance than Leaders do is on graphic design. The visual appearance of thought leadership documents is, of course, crucial. But the ideas contained in those documents are even more so.

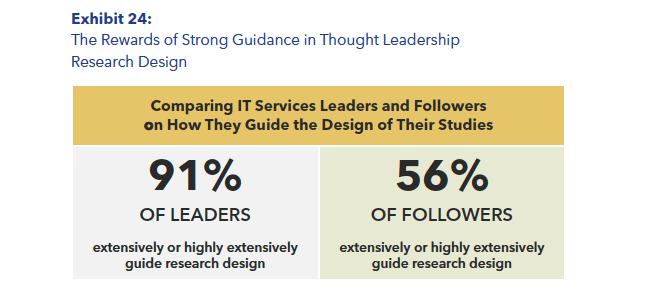

The biggest gap between Leaders and Followers in how they guided their content developers was in research design: 91% of Leaders do so; only 56% of Followers do so. (See Exhibits 24 and 25.) From our experience, this doesn’t surprise us.

The three of us (separately and together) have designed dozens of primary research studies over the last three decades for consulting and IT services companies. We tell companies that the research design stage is where they plant the seeds for illuminating findings to grow — or not. Decisions made in this first phase of the research process greatly determine whether the research findings will be deep vs. superficial, novel vs. nothing new, and persuasive vs. highly arguable.

Francis Hintermann, global managing director of Accenture’s global thought leadership research group (Accenture Research), explained to us that the company’s choice of research topics and issues to investigate “is a work of co-creation. It starts with our colleagues in the business practices of our industry groups, and our colleagues in marketing, and our clients and ecosystem partners.”

Jerome Buvat, vice president and global head of the Capgemini Research Institute, knows this well. “You need to choose a topic that is researchable,” said Buvat, who has led the €22 billion consulting and IT services firm’s thought leadership group since 2019. “This sounds very basic. But so many of our colleagues come up with brilliant ideas that are not researchable in the sense that … you’ll be able to find answers in the market or with clients. … It’s very important to bear that in mind. I think the success of the quality of the content will come from the quality of the hypotheses and the quality of the questions you’re asking.”

With the explosion in thought leadership studies, rigorous research design is no longer a luxury: in topic bounding (determining a topic that is researchable given the constrains of time and budget), initial hypotheses generation (to find “white space” in the market), and research methods selection (using quantitative surveys, qualitative “best” and “rest” practice case study interviews, and generative AI for extensive desk research).

Perhaps because many are less experienced at conducting thought leadership primary research, the Followers were far more likely to work with research or publishing companies on studies. We asked what percentage of their studies were co-branded with and conducted by research, analyst firms, and publishers.

The ratio for Followers is 35%/65% — 35% conducted internally; 65% conducted by outsiders. The ratio for Leaders was very different: 58% conducted in-house vs. 42% co-branded and conducted by external partners. (See Exhibit 26.)

Leaders Lean on Earned Media, Followers More on Paid Media

We also wanted to know how IT services firms market thought leadership content — whether studies, white papers, books, op-ed placements, or other material. For example, do they use their company website blogs or social media posts (both of which are free) more often than paid advertorials or search engine ads? What’s more, we wanted to understand their emphasis among four basic marketing channels: owned, earned, shared, and paid media.

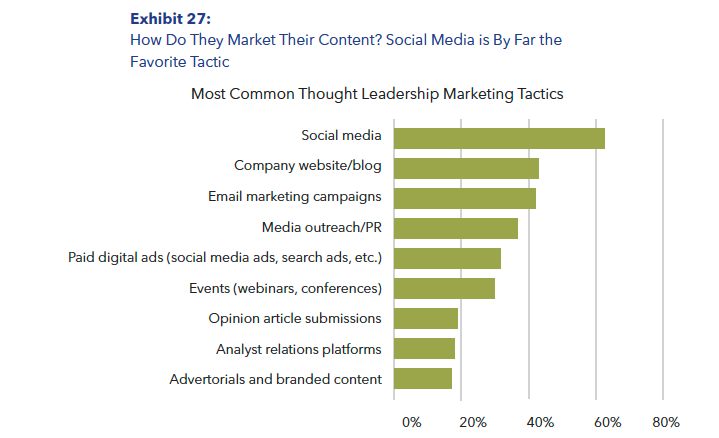

First, let’s look at their thought leadership marketing tactics. In frequency of usage of nine tactics, the most popular by far is social media channels (by 63%). A distant second and third are their company’s website (43%) and email marketing (42%). Much lower on the list: op-eds (19%) and advertorials (17%). (See Exhibit 27.)

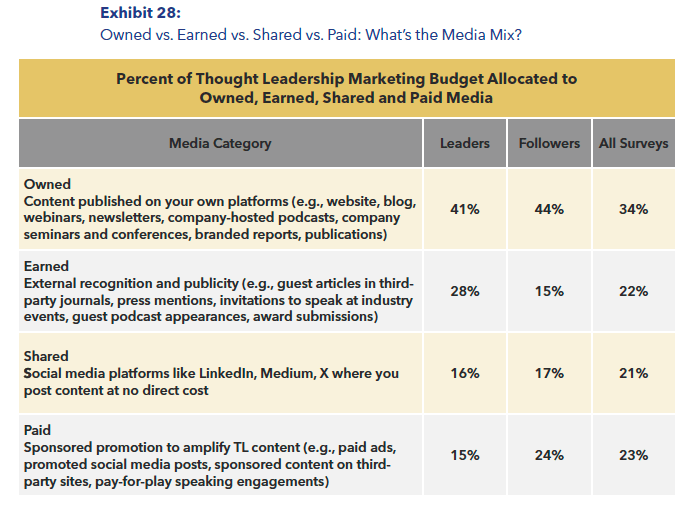

In marketing tactics, there was little different between Leaders and Followers. The most frequently used tactic by both were their company website/blog (used by 58% of Leaders and 60% of Followers). The only big difference was in paid digital advertising: 36% of Followers did this vs. only 14% of Leaders.

What did Leaders and Followers emphasize among the four basic categories of marketing channels? And did that differ much among all IT services companies surveyed?

The only sizable difference was in earned media: Leaders allocated a much larger percentage of their thought leadership media budget to earned media (28%) than did Followers (15%). (See Exhibit 28.) We’ve long contended that earned media is the most valuable type, in part because it’s the hardest to attain. Earned media are platforms (publications, conferences, seminars, webinars, etc.) that external gatekeepers (editors, conference organizers, and others) invite others to participate in solely on merit, without requiring “pay for play.” The op-ed you send to an IT publication or Harvard Business Review; the invitation to speak at an industry event (and sometimes be paid for); the podcast invitation without a fee – all those are examples of earned media.

Earned media is powerful for thought leaders because it increases their credibility. A well-respected conference, business journal, podcaster, or business magazine is opening up its digital or print pages, conference speaking agenda, or podcast channel to you. Our finding that Leaders in thought leadership commit a larger share of their marketing budget to generate earned media is what we would expect.

Advocates: Having Champions in the Right Places

The most talented thought leadership group can’t get much traction if others in the firm ignore its invitations to collaborate. And without strong involvement and sincere encouragement, thought leadership is not likely to have much, if any, revenue impact if its activities and their outputs are dismissed internally.

Conversely, one or all of us have worked with (or at) consulting and IT services firms that revere thought leadership: Accenture, Deloitte, Tata Consultancy Services, Cognizant and (a long ago) a unit of Computer Sciences Corp.’s management consulting division, CSC Index, in the 1990s. We have seen the importance of having the CEO and practice leaders who recognize the power of groundbreaking insights to open doors to clients’ CEOs, business unit leaders, C-suite chiefs, and chief information officers. The people producing and marketing thought leadership need advocacy — not benign neglect — in high places in their firm.

“Thought leadership needs to be CEO-led,” Malcolm Frank, Cognizant’s executive vice president and chief strategy and marketing officer from 2005 to 2019, explained to us: “It requires senior leadership. We had remarkable leadership from Frank D’Souza.” D’Souza was Cognizant’s CEO from 2007 to 2019, a period in which revenue soared sixfold (from $2.8 billion to $16.6 billion) and market cap more than threefold (from $12 billion to $41 billion). In 2019, D’Souza co-founded tech services-focused private equity firm Recognize, where he is managing partner.

Said Malcolm Frank: “Frank [D’Souza] really believed in thought leadership at Cognizant. And it wasn’t just him. It was our incredible board.” On that board, Cognizant’s thought leadership advocates included then-board members John Klein[i] (board chair) and Robert E. (Bob) Weissman, whom Frank said, “was a very important voice in this.”[iv]

But far more frequently we’ve seen little company collaboration with, and encouragement of, their thought leadership groups. These behaviors can play out like this:

- Practice leaders and consultants: When they make little time to let thought leadership researchers, writers, and editors tap their expertise, the firm’s content exudes superficiality and impracticality.

- Marketing: When marketing underestimates the potential client interest in groundbreaking studies, such research (starved of marketing investments) suffers a long uptake or is shuffled aside when it’s time to promote the next study in line (no matter how weak it may be).

- Sales: Even when marketing invests heavily to promote a groundbreaking study, thought leadership merely becomes an intellectual, “brand-building” exercise when business developers don’t know how to answer client inquiries about it and how to open doors with it. (In some companies, “brand building” can be a euphemism for “We have no idea if it had any value.”) Helping generate revenue needs to be Job 1 for thought leadership groups.

- Service innovation: When heads of practice development or service delivery view thought leadership as expensive marketing brochures promoting woolly concepts, they don’t recognize the service innovation potential of thought leadership research. This can be hugely frustrating for researchers who discover an emerging best practice that the firm could pioneer and, if a service offering were developed, could become a premium-priced new revenue stream.

From our experience, without strong internal collaboration on those four fronts, a thought leadership group is destined to become an internal “ivory tower” – a thinktank isolated from being able to help marketing drive market interest, salespeople sell, and service innovation heads deliver new methods and unique services.

Turning CEO Advocacy into Company Advantage

What does it take to turn IT services CEOs and their direct reports into staunch advocates for thought leadership? The key element is getting them to recognize how thought leadership can be used to out-market, outsell and out-deliver the competition. In short, it requires understanding how thought leadership – if given the license from the top of the firm and executed expertly — can confer a competitive advantage.

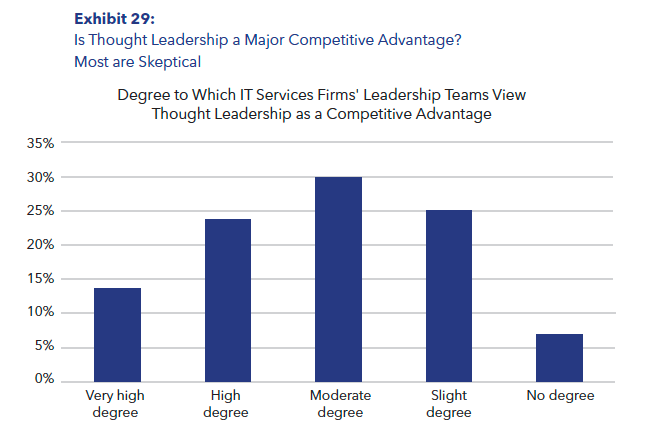

Yet most of the IT services firms we surveyed don’t see it that way right now. We asked them to rate on a five-point scale (no degree to very high degree) the extent to which top management in their firms viewed thought leadership as a competitive advantage. Only about one in seven (14%) said “very high degree.” About a quarter answered “high degree.” But many more — 62% — said “moderate,” “slight” or “no” degree. (See Exhibit 29.)

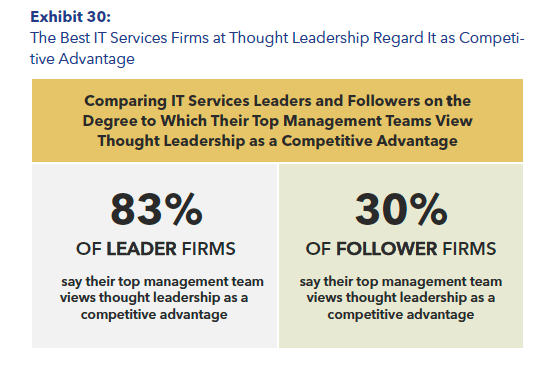

However, this view – thought leadership as competitive differentiator – is one that clearly separates the most from the least proficient IT services firms at thought leadership. Some 83% of the Leader firms’ top management views it as a competitive advantage. That’s nearly three times the percentage (30%) of the Follower firms. (Exhibit 30.)

In fact, thought leadership is a key way that tech services private equity firm Recognize seeks to differentiate its portfolio companies. Founded in 2020, the firm invests exclusively in one sector (IT services) and currently manages over $3 billion in client assets across 13 portfolio companies. “Improving how our portfolio companies drive differentiation, which includes driving thought leadership and being smart about solving problems, is a very critical factor,” Anup Hira, a Recognize partner, said to us. “We want to see things that drive the P&L and the valuation: how customers talk about them; feedback from their [technology company] partners; and analysts’ feedback.”

When Top Management Views Thought Leadership as an Advantage, They Get Involved

Along with asking their views on thought leadership as competitive advantage, we wanted to know how involved top management was in developing content. Were they hands off – delegating this to junior consultants, editors, writers, and researchers? Or did practice heads and other company leaders write articles? Did they work with content developers to codify expertise and turn it into blogs, white papers, seminar presentations, and more?

We asked companies to tell us how involved top managers were in content development. We asked them to choose which one of the following statements best characterized their “state of involvement” in thought leadership:

- None: Leadership does not contribute to or participate at all.

- Limited: Leadership occasionally shares ideas but doesn’t contribute content in whole form

- Moderate: Leaders provide insights and appear in some content (e.g., articles, marketing events, interviews)

- High: Leaders actively shape and review content, and present it (author articles, do public speaking)

- Extensive: Leaders drive thought leadership strategy, author key articles, and participate in marketing events.

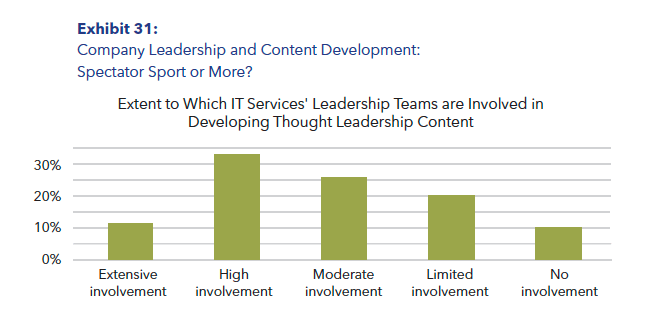

As you can see in Exhibit 31, a small majority of IT services firms (54%) said company leaders are, at the most, moderately involved in developing content. But one big “aha” to us: A high percentage – 44% — said top managers in their firm were highly or extensively involved.

Comparing Leaders and Followers showed a sizable difference in involvement. Some 86% of top management in Leader firms are highly or extensively involved – nearly eight times the percentage in Follower companies. In fact, at 60% of Follower companies, top management is only slightly or not involved at all in content development. None of the 36 Leader companies had zero to slight leadership involvement in content. (Exhibit 32.)

“The importance of [thought leadership] at Accenture is directly related to the engagement of our CEOs since the end of the 1990s,” Accenture Research’s Hintermann explained to us. The company’s market cap has grown from about $14 billion in 2001 (the year of its initial public stock offering) to $150 billion by October 2025. Revenue has increased fivefold since 2002, to $68 billion.[v] “All of our CEOs have had a strong engagement in thought leadership.”

Why have Accenture’s top leaders strongly believed in thought leadership for four decades? In a world in which the half-life of conventional wisdom has declined markedly, Hintermann said it’s crucial for the firm to bring new wisdom to the table. “We are convinced that the first thing we have to address when we meet clients, when we meet CEOs and the rest of the C suite, is to change the business ideas they have in mind. Any change starts with a new business idea. And that’s why we’ve been investing” in thought leadership for so long. Hintermann’s 300+ thought leadership group is testimony to the power of the new ideas it continually brings to market.

It’s hard to argue with that, looking at Accenture’s revenue growth since 2002, and comparing it to such competitors as DXC Technology (from $11 billion revenue in 2002 to $13 billion in 2024).[vi]

Capgemini’s leaders have had similarly high involvement in thought leadership initiatives for years. The France-based global consulting and IT services firm, whose revenue nearly doubled between 2010 and 2024, makes sure it has a company executive “sponsor” each research study it takes to market, according to Buvat, the head of the Capgemini Research Institute. “We have a very senior sponsor for every single piece.” His research group asks those sponsors what they want the studies to explore, and what they predict the research will find.

When top management knows thought leadership can drive revenue – and if they get productively involved in the company’s thought leadership activities – they can start seeing the impact. Past clients who haven’t been in touch reach out to talk about a new research report. A door that’s been closed for years at top levels of a large company opens. That’s when top management sees thought leadership as a competitive advantage.

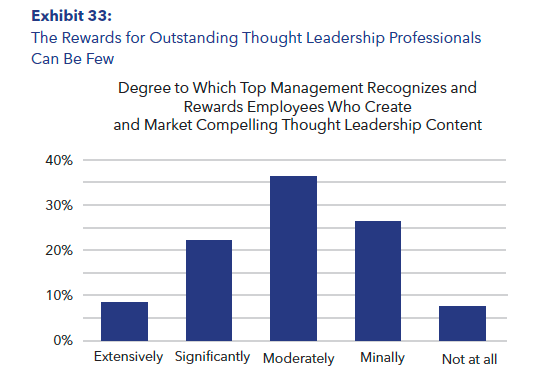

Then the most progressive IT services executives realize that to keep their thought leadership machine cranking out hits, they must recognize and reward those responsible for those hits. On this front, the IT services industry may be behind other B2B sectors (especially consulting and financial services) in rewarding their best thought leadership professionals. When we asked survey respondents to indicate how much company leaders recognize and reward employees who create and market compelling content, the percentages were disappointing. Only 8% characterized it as “extensive.” Four times that number said “not at all” or “minimally.” (See Exhibit 33.)

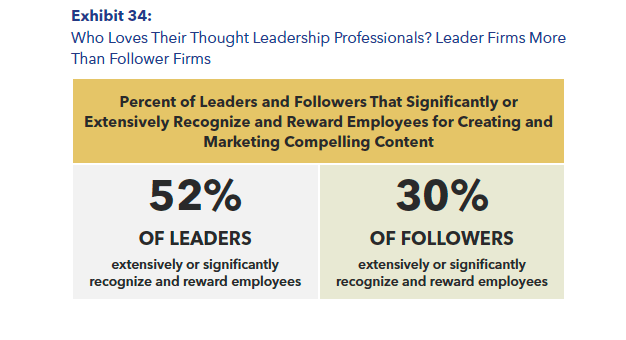

But this, again, is one major way that Leaders differ from Followers. Slightly more than half the Leaders said such recognition and rewards were significant or extensive. Only 30% of Followers said the same. (See Exhibit 34.) Still, with only slightly more than half the Leaders strongly rewarding their thought leadership staff, all IT services companies have work to do to keep their best thought leadership professionals.

Connections: Tying Thought Leadership to Demand and Supply of Services

Exceptional thought leadership content has little impact as a PDF with nary a download, or as the focus of a press release that’s been ignored by the press. Unless the findings of a groundbreaking study find their way into business developers’ pitches to clients or marketing’s pitches to media and other influencers, it’s just another forgotten study.

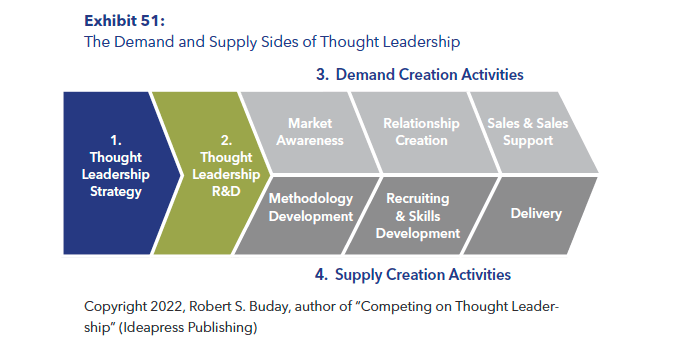

And that’s just on what we call the “demand” side of thought leadership – that is, a company’s marketing and sales activities that put its big insights into the hands of companies that are motivated to make big changes. The “supply” side of thought leadership can be an ever more neglected stepchild. By supply, we mean the people in an IT services firm paid to create methodologies that its consultants and software development people use to run projects, as well as the internal training & development programs that those “delivery” personnel use to get up to speed on the latest service development.

We had a few questions in our survey about how much thought leadership research departments are collaborating with their colleagues on the supply and demand sides. The short answer is they’re collaborating somewhat on the demand side (but not nearly enough with salespeople). And they’re hardly on the same planet with the supply side of their companies, collaborating sporadically if at all with service innovation and service delivery.

Let’s start with the supply side of the house. You may recall the finding we cited near the beginning of this report about the most important reasons for investing in thought leadership. As the exhibit below shows, it is sixth on the list of reasons we offered. Less than a third (30%) said it was a top three reason for investing in thought leadership.

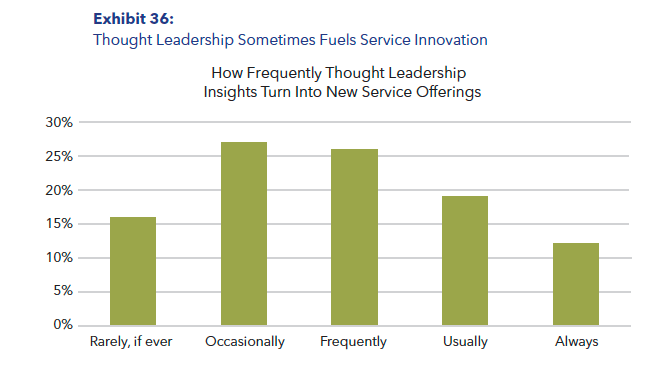

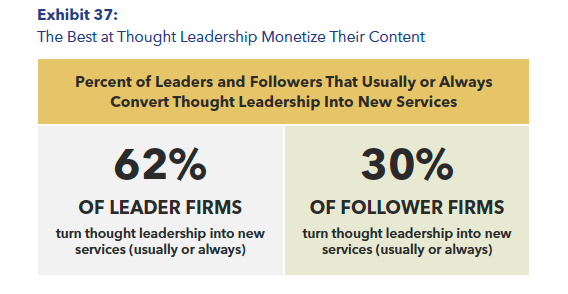

It’s not that service innovation groups are altogether ignoring thought leadership as a key input. In fact, 31% say that usually or always convert the insights of thought leadership research into service offerings. But a greater percentage – 43% — say they do this only occasionally or rarely, if at all. (See Exhibit 36.)

The best IT services firms at thought leadership – our so-called Leaders – are twice as likely to turn thought leadership into service offerings than the Followers. Some 62% of Leaders say they do it vs. 30% of Followers. (Exhibit 37.)

Buvat, Capgemini’s thought leadership research chief, has watched this happen. “Some of our research is the trigger for new offers. Some our consultants, on the back of our research, come up with ideas, saying, ‘We didn’t realize that our clients were so interested.’” Hintermann said it’s highly rewarding to see his group’s research findings cited in Accenture consulting reports for clients.

As head of strategy, marketing and thought leadership at Cognizant for many years, Malcolm Frank was in the perfect position to see how primary best-practice research could lead to new service offerings. “Thought leadership done properly, is a sense-and-respond vehicle,” he said to us. “It’s not three people in a room, ivory tower model, cooking up ideas. I always told people, ‘You have to go on the walk: Spend lots of time with lots of clients and have conversations, do presentations, get white papers in front of them.’ … This is how it comes back into strategy. Very quickly you’re going to see a market [opportunity]. That enables you to move much faster than the competition.”

But, again, only 31% of all IT services firms surveyed said regular turn thought leadership into service innovation. And we wonder how serious even the Leaders are at this game. Only 25% of them said it was a top three driver. Still, that was more than twice the number of Follower firms that said the same. (Exhibit 38.)

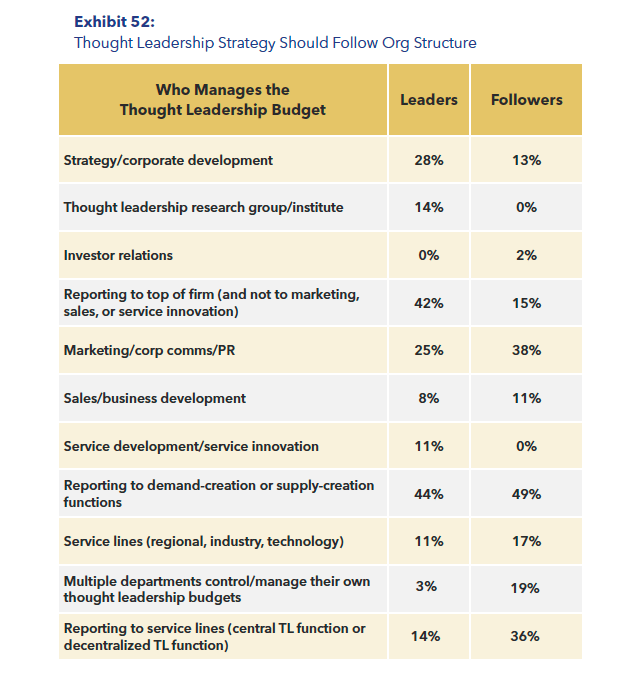

Another indicator that most IT services companies don’t see the opportunity to “scale” groundbreaking thought leadership research – “scale” meaning training dozens or hundreds of internal people to master the expertise gained by the authors of the studies – can be seen in our question about who controls the thought leadership budget. Only 5% of the firms we surveyed said service delivery/service innovation controls the budget. Only 11% of the Leaders said service delivery manages the thought leadership budget. Not one Follower firm’s service delivery group runs thought leadership. (See Exhibit 39.)

The connection between thought leadership and service innovation has yet to be made. That, we believe, is a major opportunity for IT services firms that want to leapfrog past their competition in thought leadership: Turn their most compelling best-practice research into new services.

Thought Leadership’s Connection to Sales is Typically Weak

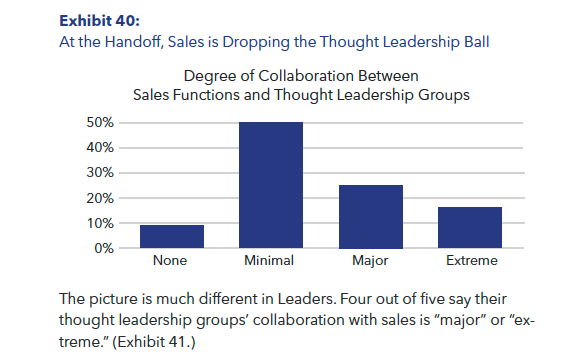

How about the connection between thought leadership and sales? It’s stronger than the weak or non-existent tie between thought leadership and service delivery. But it’s not significantly stronger. When we asked about how much thought leadership and the sales function were collaborating, nearly 60% said “not at all” or “minimally.” Here is how we defined those terms (Exhibit 40):

- No collaboration: Salespeople don’t know about thought leadership content until clients get it.

- Minimal collaboration: Salespeople are informed about the company’s thought leadership programs before they go to market but aren’t prepared to go prospecting with it.

- Major collaboration: Marketing prepares the sales organization long before content goes to market — on whom to target, how to open doors, etc.

- Extreme collaboration: Marketing trains salespeople on how to sell services to prospects who respond favorably to thought leadership programs.

That is a warning sign for the 59% of thought leadership groups that do great work but are shunned or given short shrift by their firm’s sales force. In a world of increasing competition among tech services firms, and mounting customer confusion about how to solve their problems and which IT services can best do it, salespeople need thought leadership at the point of sale more than ever. “The Challenger Sale” book established that in the last decade. A new book, “The Framemaking Sale,” makes an even tighter connection between thought leadership and business development.[vii]

This is important at IBM’s Institute for Business Value group. “In our offering content, we make sure that our thinking and our data is contained therein,” Marshall noted. “And there are specific big deals … where we assign the most relevant individual (within IBV) to engage with that deal team.”

Capgemini’s thought leadership research group goes a step further. It uses AI to help sales teams better understand and use its content. “For each report, we have an AI tool, an AI agent, if you will, that our sales colleague can use to ask any question they want,” Buvat said. “Instead of having to read the report if they have a question from their clients, they can actually ask the tool, and know, immediately.”

The picture is much different in Leaders. Four out of five say their thought leadership groups’ collaboration with sales is “major” or “extreme.” (See Exhibit 41.)

For Accenture, thought leadership is embedded in its business culture. This means thought leadership content isn’t produced and marketed by an isolated team in an ivory tower. “It’s produced with business leaders. It’s co-marketed with business leaders,” Accenture’s Hintermann told us.

“Every time we publish a piece, it’s sent to the group executive committee so they are aware, and then they forward and cascade that onto their own teams,” Capgemini’s Buvat explained. The firm has a communications platform called Daily Connect, and 80,000 Capgemini employees follow the company’s thought leadership group. Many use it regularly.

Talent: Acquiring It, Developing It, Retaining It

Our research suggests there’s an acute talent shortage in thought leadership. The number of highly skilled thought leadership professionals – whether researchers, editors, marketers, market event managers or others – is extremely finite.

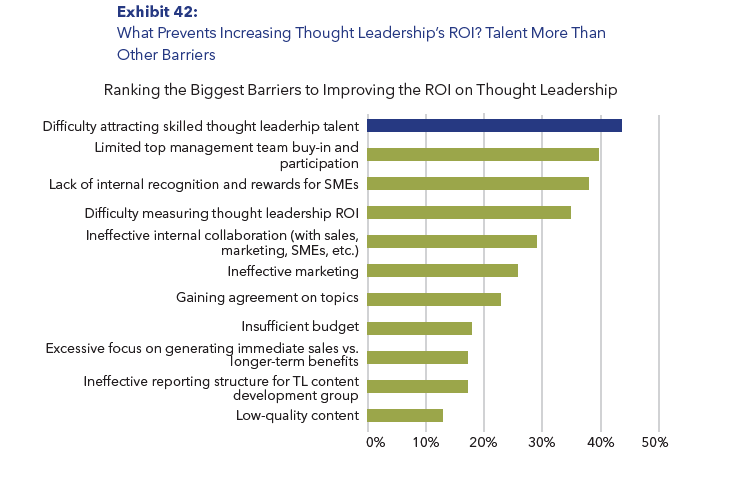

What leads us to say this? We asked IT services firms to name the three largest barriers to dramatically increasing the ROI on thought leadership. We gave them 11 barriers from which to choose their top three. Attracting skilled thought leadership people was the biggest barrier, chosen by 44% as a top three obstacle to higher ROI. They mentioned it as a big barrier even more frequently than they did another big barrier: measuring the ROI on thought leadership. (See Exhibit 42.)

How Big is the Thought Leadership Talent Shortage?

Getting sales and service development chiefs in thought leadership’s corner doesn’t happen by sheer force of personality alone. Even the most persuasive thought leadership chief is not likely to win over heads of sales and service development unless his or her “products” – especially research reports, white papers and books – are compelling enough to open client doors.

In turn, the quality of a thought leadership group’s products is the result of a) rigorous content development processes (as we wrote about in the “Process” section) and b) the abilities of the researchers, writers and editors who follow those processes. The skills of those thought leadership content professionals make or break those processes.

This is a fundamental “talent” piece of the thought leadership puzzle. (Skilled marketers who know how to promote thought leadership content are another.) We asked the 300 IT services firm to sum up the skills of their thought leadership content professionals – the people who produce their research reports, white papers, presentations and other educational (vs. blatantly promotional) content. We didn’t ask them to rate their skills of their marketing team. We asked them to assess their content talent as a whole, on a five-point scale, from best to worst:

- Talent abundant: Very highly equipped to produce content that is widely recognized, sets industry benchmarks and influences clients, analysts, and competitors.

- Talent rich: Highly equipped to regularly produce high-quality content that resonates with audiences.

- Talent inconsistent: Moderately equipped with solid expertise but inconsistent execution.

- Talent deficient: Somewhat equipped but struggling with depth, originality, and consistency.

- Talent devoid: Not at all equipped with the skills to produce content with impact.

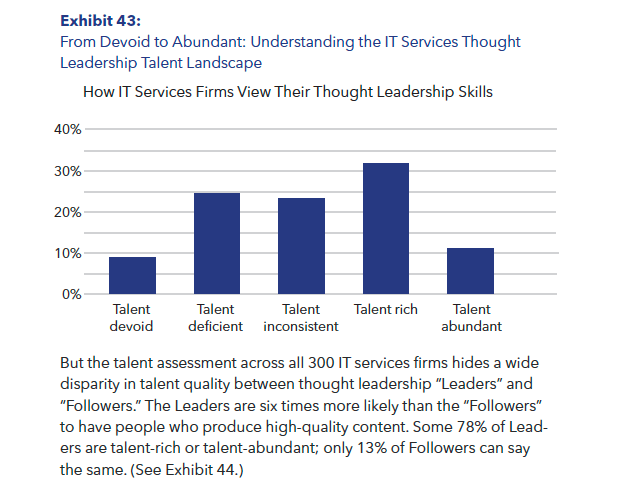

About a third (34%) put themselves in our talent deficient or devoid categories. About a quarter (24%) rated themselves as talent inconsistent. And 43% gave themselves high marks as either talent rich or talent abundant in producing compelling content. If you view the label “talent inconsistent” as neither strong nor weak, then IT services firms with strong thought leadership talent outnumber the ones with weak talent, 43% to 34%.

Still, only about one in 10 rated their content teams as “talent abundant.” (See Exhibit 43.)

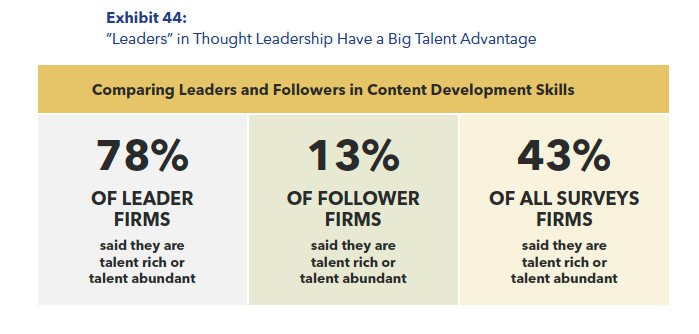

But the talent assessment across all 300 IT services firms hides a wide disparity in talent quality between thought leadership “Leaders” and “Followers.” The Leaders are six times more likely than the “Followers” to have people who produce high-quality content. Some 78% of Leaders are talent-rich or talent-abundant; only 13% of Followers can say the same. (See Exhibit 44.)

What Skills Count Most in Thought Leadership?

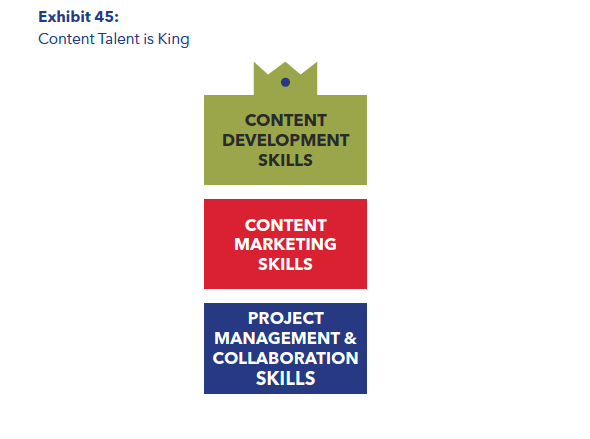

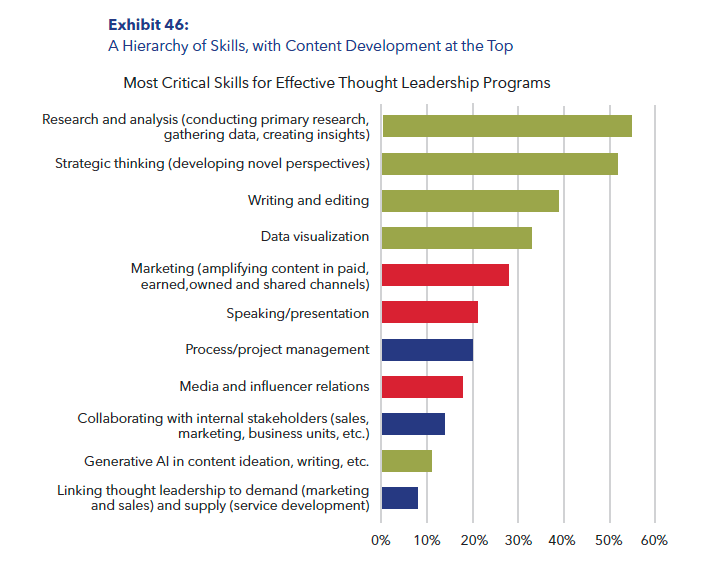

We wanted to hear from IT services firms about the skills they believed were the most critical to running effective thought leadership programs. We asked them to pick the three most important skills from a list of 11. (See Exhibit 46.) Generally, we found that skill requirements can be seen in a hierarchy of three types, starting with the most important (Exhibit 45):

- They regard content development skills as the most important (we’ve made green bars for these skills), followed by …

- Marketing skills (bringing thought leadership content to market – see the red bars), followed by …

- Program/project management and collaboration skills (blue bars)

We found little variance between “Leaders” and “Followers” in what they see as their three most critical thought leadership skills. Only two skills showed some difference (more than 10 percentage points):

- Process and project management: 32% of “Followers” said this was a top three skill, but only 19% of “Leaders” said the same.

- Generative AI proficiency in content ideation and writing: a top three skill of 17% of Followers but only 6% of Leaders.

Which Skill Needs the Biggest Improvements? The Ability to Make Insightful Arguments

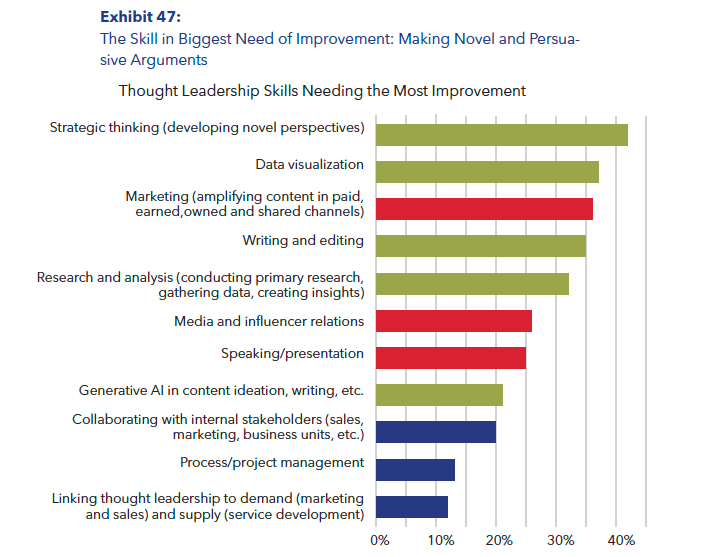

After asking them which three skills were most critical to thought leadership, we then asked which three of those same 11 skills they needed to improve the most. They cited five most often, four of which are content development skills and one a marketing skill. (See Exhibit 47.)

One skill stood above all others in the frequency with which IT services firms said it must be improved: strategic thinking. In the survey questionnaire, we defined this as “developing unique, forward-thinking perspectives to be used in thought leadership content.” Put another way, it’s about making a novel, persuasive argument on a business/technology problem and a superior way to solve it.

From our experience, there are two core “subskills” required to develop unique, forward-thinking arguments. The first is the ability to extract groundbreaking insights from research data, case studies, and client experiences. Pattern recognition is crucial to insight-making. The second subskill is narrative development: the ability to construct a powerful argument (from insights that are based on data and best-practice case examples) on superior ways to solve the issue at the heart of a study.

The ability to make novel and persuasive arguments about better solutions to complex business problems is the rarest of all skills in thought leadership. It no wonder that the business world since 1990 has revered these thought leaders on how businesses should capitalize on digital technology:

- The late Harvard Business School Prof. Clayton Christensen (known for “disruptive innovation”)

- The late Michael Hammer (“business reengineering”)

- Professors Eric Brynjolfsson and Andrew McAfee (the digital economy and AI)

- Prof. Thomas H. Davenport (“competing on analytics,” “generative AI and citizen software developers,” and “business process redesign”)

All had or have the capability to a) conduct deep research on how companies used digital technologies and b) identify practices that lead to quantum improvements in revenue, cost, quality customer retention, profitability market share, and other core measures of business success. They mastered the art of making novel, persuasive arguments.

“You have to surround yourself with thinkers,” said Perignon of Tata Consultancy Services. “You have to have the writing part; you can always figure that out. But you must have a team of great thinkers” – idea people who can use data to “construct compelling arguments,” he told us.

Every IT services firm now needs people inside their company — or business partners such as professors and independent consultants — who excel at making unique and persuasive arguments. Like Christensen, Hammer and the others, they need to thrive at leading rigorous, best-practice thought leadership research. IT services firms with a high-powered primary research capability have a big advantage over those that don’t. Said Perignon: “There is no way we can make an impact and have our own differentiated voice without research-based thought leadership.”

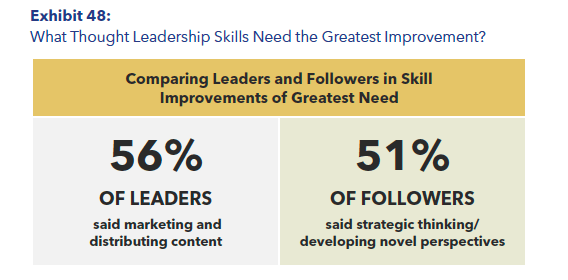

In comparing Leaders and Followers on the skills in which they need the most improvement, we some interesting differences. Leaders more often said it was marketing and distribution (56%). (See Exhibit 48.) Followers more often said their No. 1 skill area for improvement was strategic thinking/creating novel perspectives.

Winning the Thought Leadership Talent War

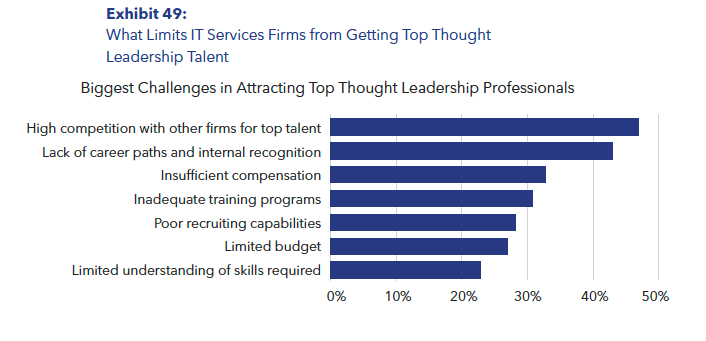

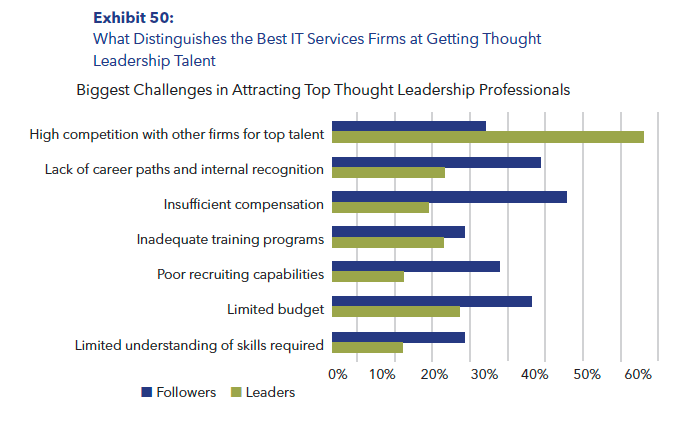

We asked IT services firms about their biggest hurdles in attracting top-tier thought leadership professionals, whether researchers, editors, marketers, or others. From a list of seven, we asked them to choose the ones that hampered them most.

The most frequently cited hiring challenge: high competition with other firms for top talent (meaning, in part, that compensation may be a hurdle). Nearly half (47%) cited this. The second was lack of career paths and internal recognition for thought leadership roles. Some 43% chose that. (See Exhibit 49.)

How “Leaders” and “Followers” answered this question speaks volumes about how they value thought leadership talent.

Twice as many Leaders than Followers say a top challenge is competing for thought leadership talent. We interpret this data this way: The best IT services firms at thought leadership know there is a severe shortage of exceptional talent (especially in researchers and editors to develop content). They know the salaries such people command in the marketplace. And that, we feel, is why fewer Leaders (19%) than Followers (46%) say compensation is a key challenge. Leaders know what they have to pay these people to attract them.

The best IT services firms at thought leadership better understand the skills they need, which also makes them better at evaluating people who knock on their doors. It’s why, we believe, only 14% of Leaders said “limited understanding of skills required” was a challenge, and only 14% said they had poor recruiting capabilities. (Some 33% of Followers said their recruiting capabilities for thought leadership talent was poor.) (See Exhibit 50.)

Structuring: Where Thought Leadership Reports Determines How Much Impact It Can Have

We’ll make a bold statement here, one that we believe no other research on thought leadership has made to date: Where a thought leadership group reports in an IT services firm – or for that matter, in any B2B company – determines how much impact it can have on the firm’s top and bottom line.[viii] Where your thought leadership group appears on your organizational chart matters greatly.

Second bold statement: If your thought leadership group doesn’t report to an executive above marketing, sales, and service innovation, your firm will diminish its ability to drive revenue and service innovation.

Here’s our reasoning: If thought leadership research reports to marketing, it becomes captive to marketing’s interests – increasing the firm’s brand recognition and reputation. The downside of this is that others in an IT services firm – especially service line leaders, consultants, service innovation officers, and service delivery heads – then view the marketing organization’s thought leadership content in the same way they view other marketing collateral: more or less, as fancy promotional material.

This doesn’t at all minimize the importance of marketing to promote groundbreaking ideas. Effective press outreach, memorable social media posts, insightful marketing events, and other well-run marketing activities are fundamental to getting big concepts noticed in the marketplace. In fact, one long-time IT services veteran we spoke to, Praveen Bhadada, sees marketing as more important than thought leadership to the growth of IT services firms. “I score great marketing higher than great thought leadership,” said Bhadada, a former chief of staff to the CEO of Persistent Systems (a $1.3 billion Indian IT services firm), an ex-managing partner of Zinnov, and now CEO of NEOVAY Global (a consultancy to tech services and tech firms). “[Having high] analyst ratings at Gartner will give you a lot more leads than an in-depth white paper on product engineering. Yes, you will get some applause on LinkedIn, but that’s not going to generate many leads.”

But in our experience, when a thought leadership research group reports to marketing, its output is seen as marketing content – not content with the seeds for new services. It precludes other people in an IT services firm from viewing groundbreaking thought leadership research as content to ignite new services or create new methods for existing services. Where a thought leadership group reports in an organization will dictate its strategy – which includes which functions will be its beneficiaries.

That strategy should be to fuel both demand-creation (marketing and sales) and supply-creation (service enhancement and innovation). Thought leadership’s place on the organization chart determines its strategy. Bob Buday’s book graphically illustrates this[ix] (Exhibit 51):

We can back up this assertion from our interviews, survey data and vast experience in thought leadership at IT services firms – working in these firms and consulting to them. At Leaders, marketing controlled the thought leadership research budget in only a quarter of them, compared with 38% of the Followers. In 42% of Leaders, the thought leadership budget was controlled by a thought leadership group or by strategic planning/corporate development. That was the case in only 15% of the Followers. (See Exhibit 52.)

In none of the Follower firms did the thought leadership research group control and manage its own budget.

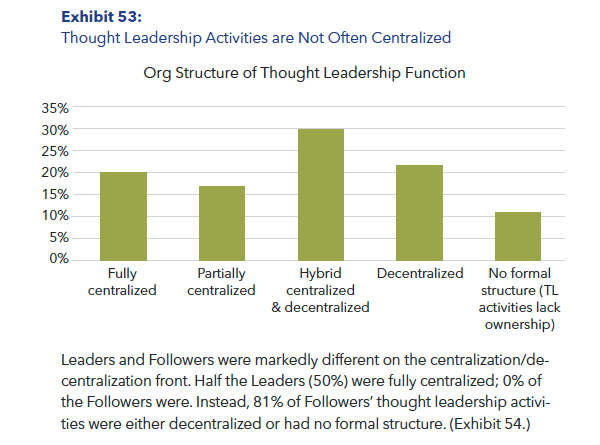

Other data on our Leaders and Followers show how IT services firms can empower or neuter the impact of thought leadership by how they structure it. We asked our survey respondents what thought leadership activities are centralized, decentralized, or a mix of the two. The most common structure was “hybrid”: thought leadership strategy (most importantly, what topics to create content on) was set centrally, but business units had power to create their own content on those topics. Some 30% of respondents said this was how thought leadership operates in their firms. (See Exhibit 53.)

The next most frequently mentioned structure, by 22%, was decentralization: Business units and other client-facing teams independently manage their own thought leadership activities. But only one in five IT services firms surveyed said their thought leadership activities are fully centralized.

Half the Leaders have a dedicated thought leadership group. In stark contrast, not one of the Followers has one.

Leaders and Followers were markedly different on the centralization/decentralization front. Half the Leaders (50%) were fully centralized; 0% of the Followers were. Instead, 81% of Followers’ thought leadership activities were either decentralized or had no formal structure. (Exhibit 54.)

That makes it easier to understand why the thought leadership groups in the best IT services firms for thought leadership have a much larger headcount than those in the Follower firms. Leaders have an average 9.7 people dedicated to thought leadership vs. 2.8 for Followers.

Centralized thought leadership groups enable an IT services firm to:

- Decide what topics to cover or not to cover.

- Generate a uniformity of messages, rather than studies that come to market that contradict other studies in the firm that come to market around the same time.

- Give thought leadership researchers, editors, writers, and graphics people the opportunity to sharpen each other’s skills.

As we mentioned previously, centralized thought leadership groups that report to the top of the company (either to the head of strategy, finance, the COO, or CEO) increase the chances that their research is embraced by both the demand side of the house (marketing and sales) and supply side (service development and innovation).

We also must state that thought leadership shouldn’t report to service development/innovation, and for a similar reason it shouldn’t report to marketing or sales. If thought leadership reports to service delivery, it will be encouraged to capture the firm’s existing client work and current methods – not do primary research on best practices that might go way beyond the firm’s client base.

The wrong reporting relationships do impact thought leadership. Only about one in five Leaders (vs. 40% of the Followers) said an ineffective reporting relationship was a big barrier to improving their ROI. Thought leadership should report to strategy or above, as it does at Accenture. The company’s 350-person thought leadership research group, Accenture Research, has been reporting to the its chief strategy and innovation officer (Bhaskar Ghosh) since 2020.

Over the last five years, IBM has increasingly centralized its thought leadership research in internal thinktank, the IBM Institute for Business Value. As Anthony Marshall, global leader of IBM IBV, told us: “Five years ago, thought leadership in IBM was more fragmented. Various parts of the organization would produce thought leadership of varying degrees of quality. Some of it was good, some of it wasn’t. What has happened over the past five years is greater centralization within the IBV, and a greater delineation of responsibilities between marketing and IBV. That’s been extraordinarily positive.”[x]

IBV is now seen as the thought leadership content creation engine in IBM, Marshall said. “Marketing is now focusing on what it does best: deploying and enabling that content, and making sure it drives maximum value for clients and the business. This symbiosis has made us all far more effective in creating and deploying the great thought leadership that IBM is known for.”

Ben Pring put it this way: “The successful period we had in Cognizant was when we had a centralized budget. We weren’t dialing for dollars around the rest of the firm [to get funding] or trying to do cross-funding with the rest of the firm. They just funded it. That worked very well because that meant that we had one identifiable boss [Malcolm Frank] who was our Medici prince,” alluding to the Italian family that rose to political power in the 15th century. “If he was happy and saw the value of it,” it a research project was funded.

The problem of decentralized thought leadership activities funded by various business units is one of disagreements and delays, Pring told us. “Without a central figure with power and budget, you’re going to be stuck in this netherworld of complexity and non-alignment. It’s one of the reasons why many things, not just thought leadership, struggle to (achieve) escape velocity.”

[i] Note: Bob Buday made this argument in his 2022 book, “Competing on Thought Leadership.” https://www.amazon.com/Competing-Thought-Leadership-Robert-Buday/dp/1646871006/

[ii] From “Competing on Thought Leadership,” by Robert Buday, p. 40.

[iii] “The Framemaking Sale” (2025, Basic Books) by Brent Adamson and Karl Schmidt. Adamson co-authored “The Challenger Sale.” https://www.theframemakingsale.com

[iv] Accenture revenue and market cap data from Companiesmarketcap.com. https://companiesmarketcap.com/accenture/revenue/

[v] Companiesmarketcap.com https://companiesmarketcap.com/dxc-technology/revenue/

[vi] Klein joined the Cognizant board in 1998, was its chair for 15 years, and retired as a board member in 2020, culminating a 53-year career in the IT industry with IBM, Digital Equipment Corp. and MDIS. https://news.cognizant.com/2018-09-24-Cognizant-Board-Elects-Michael-Patsalos-Fox-as-Chairman and https://unitedagainstpoverty.org/employee/john-klein/

[vii] Babson College webpage, April 6, 2023. Weissman was chairman and CEO of Dun & Bradstreet in the 1990s, and divested Cognizant Corp. three years later. At that time, Cognizant, run by Weissman, included IMS, Nielsen Media Research and Gartner Group. In 1998, he spun off Cognizant Technology Solutions and was CEO of IMS until 2001. Weissman died in 2023. https://entrepreneurship.babson.edu/remembering-bob-weissman/

[viii] Harvard Business Review article, “Competing on the Eight Dimensions of Quality,” by David A. Garvin, November 1987. https://hbr.org/1987/11/competing-on-the-eight-dimensions-of-quality

[ix] Bain’s Net Promoter Score system website. https://www.netpromotersystem.com/about/

x] See the book “The ROI of Thought Leadership,” by Cindy Anderson and Anthony Marshall, of the IBM Institute for Business Value. https://www.amazon.com/ROI-Thought-Leadership-Calculating-Organizations/dp/1394308914

[xi] Edyn revenue, from its 2024 annual report.